Setting up a PayPal Business Account is a crucial step to take after you’ve formed your U.S. LLC. It professionally accepts global payments, manages your funds, and allows you to operate as a legitimate U.S. business in the global marketplace.

Nevertheless, confusion often arise from non U.S founders about how to open a PayPal Business Account with their U.S. company, especially those living outside the U.S.

This guide covers everything you need to and addresses your concerns, including eligibility and requirements, the complete setup process, and how to expedite the approval of your account.

🏢 Why You Need a PayPal Business Account for Your U.S. LLC

With a business you operate in the digital sphere, a reliable and universally accepted payment option is essential. PayPal is the most trusted payment system and works with millions of businesses around the globe.

Here’s why every U.S. LLC owner–especially those that are non-U.S. residents–should set up a PayPal Business Account:

1. PayPal Business Account Ownership and Display

Having a PayPal Business Account contributes to your company’s legitimacy and registration. With the Business Account, clients will see your LLC’s name and not a personal name. This builds trust and impartial credibility to your brand.

2. Worldwide Operation.

PayPal functions in more than 200 countries and handles more than 20 different currencies. This means that your customers to make payments from every corner of the world and avoid frustrating foreign transaction structures.

3. Easy Integration.

PayPal works with major eCommerce sites, including Shopify, WooCommerce, BigCommerce, and others. This is a great convenience to those having a digital business that aims to collect payments online.

4. Secure and Compliant

Equipped with advanced PayPal fraud protection, dispute resolution, and encrypting tech, your transactions and attained business compliance to U.S. financial regulations are ensured.

5. Invoicing and Financial Management.

PayPal creates customizable invoices and monitors transactions. This makes tracking of sales, and finances, really effective and streamlined to save time for bookkeeping, and make the tax filing process manageable.

6. Multi-Currency Functions

Having multiple balances on your account, currency conversion, and withdrawing USD straight to your business U.S. bank account, offers you flexibility and command on your international income.

🪪 U.S. LLC PayPal Business Account Requirements

Prior to creating the account, business clients LLC PayPal accounts, ensure your U.S. LLC is fully and compliant. Account restrictions and delays might occur, owing to incomplete prerequisites.

Here’s the information you need:

1. Registered U.S. LLC

You need a Limited Liability Company registered in a State of the U.S. as in Delaware, Wyoming, New Mexico, or Florida. Your Proof of Business formation i.e. articles of organization confirms your registration.

If you wish to form your LLC, then it can be done at Bizstartz, and it can be done while you are outside the U.S.

2. Employer Identification Number (EIN)

An EIN is issued by the IRS as a Tax ID for your business. PayPal needs to verify business accounts, hence it is crucial. Your account can be flagged for incompleteness on business verification if you do not provide an EIN.

3. U.S. Business Address

To register and verify your business, you want to provide a valid U.S. address. This can be:

- Your LLC’s registered address

- A virtual office address from a provider that allows business mail forwarding

Just make sure this address is the one that is listed in your LLC documents.

4. U.S. Business Phone Number

For security verification, PayPal may request a U.S. number. This can easily be obtained through apps and services such as OpenPhone, Grasshopper, Google Voice, and Skype Business.

5. U.S. Business Bank Account

To actually receive and withdraw money from your PayPal account, you will need a U.S. bank account. Suggested online banks for non-U.S. residents include:

- Mercury Bank

- Relay Financial

- Wise Business

These banks accept international founders and will easily integrate with PayPal.

6. Business Email Address

Use a professional domain-based email address such as info@yourcompany.com. Avoid using Gmail and Yahoo emails as they can look unprofessional and may cause problems during the verification process.

7. Website or Online Store

If you have an active website, include a clear explanation of your products and services as this will help PayPal verify your business. If you have an eCommerce store, make sure that your product listings and terms of service are easily accessible.

🧭 Step-by-Step Guide: How to Create a U.S. PayPal Business Account

Alright! We can now go ahead to opening your U.S. PayPal Business Account. Here’s a list of actions to take.

1. Open PayPal’s Business Page

Head to PayPal.com/business. When the page fully loads, look for a button that says “Sign Up,” and click it.

From the page opened, choose “Business Account” before you can proceed.

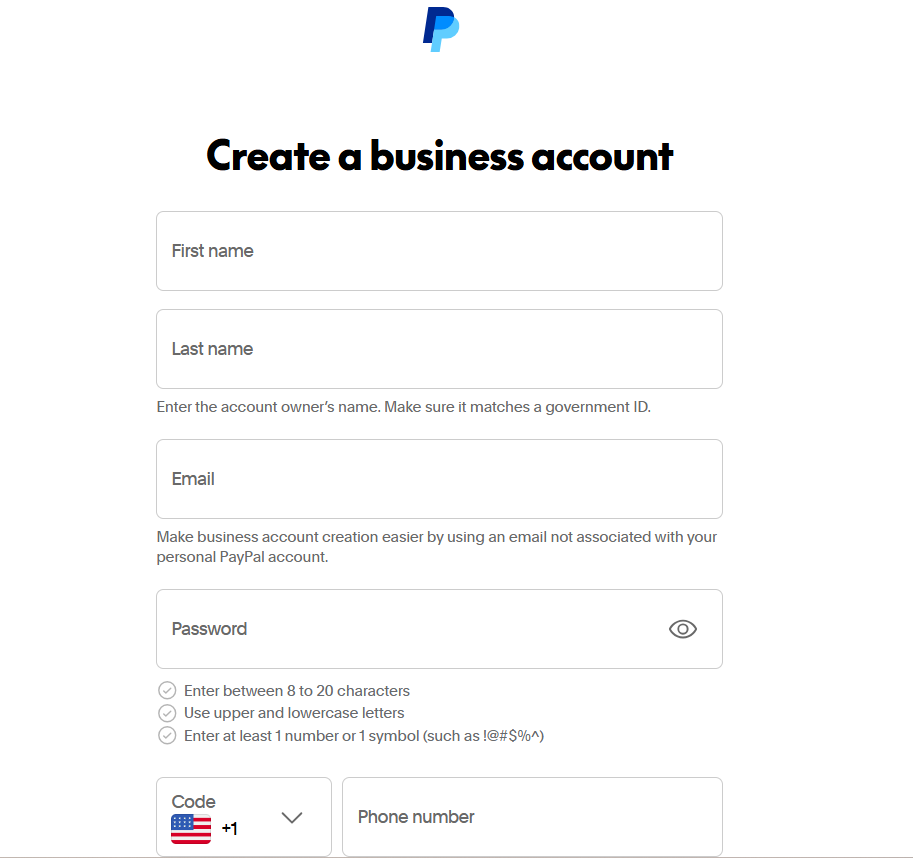

After that, you can proceeds to the registration page for opening your PayPal account.

2. Type In Your Business Email

By now, you should have created an email account for your LLC, and that should be the email you use for this PayPal account for now (for example: set up email as info@yourcompany.com).

That email will be your main contact for all emails and notifications PayPal will send you for all your business transactions.

3. Fill In Business Details

Now, you need to provide:

- Business Name as per your legal documents, LLC.

- Business Address should be your U.S. LLC Address.

- Business Phone: Your U.S. business phone number.

- For Business Type, choose “LLC” (Limited Liability Company).

- For the last item, EIN, put your LLC’s Employer Identification Number.

Check and crosscheck that every item is as per your business registration. No discrepancies.

4. Type In Your Personal Details

For this, you have to provide the information for the owner or the managing member of the LLC.

Please provide the following:

- Complete legal name

- Date of birth

- Country of residence (your home country is acceptable)

- Passport or national ID (for identity verification)

- Personal address (can be non-U.S.)

This is part of PayPal’s KYC (Know Your Customer) compliance.

Step 5: Add Business Description

Describe your business, including:

- Business category and subcategory

- Product/service type

- Average transaction size and volume

Example:

We operate an eCommerce store selling home and lifestyle products globally through an online platform.”

Ensure your description is consistent with your business website or online store.

Step 6: Link Your U.S. Bank Account

After creating your PayPal account, go to your Wallet and click “Link a Bank Account.”

You can link accounts from these banks:

PayPal will make at least two small (usually under $1) deposits to your account.

Check the precise amounts in your banking dashboard and enter them in PayPal to finish verification.

Step 7: Verify and Activate Your Account

Confirm your email address and finish any other verification steps requested by PayPal.

After verification, you have the ability to:

- Send and receive business payments.

- Create and send invoices.

- Withdraw funds to your U.S. bank account.

🌍 Can Someone Who Doesn’t Live in The U.S. Get a U.S. PayPal Business Account?

Of course!

You just need a few important steps in business for them to get a U.S. PayPal Business Account.

You have to have:

✅ A registered U.S. LLC

✅ An EIN (Tax ID)

✅ A U.S. business address

✅ A U.S. business bank account

After that, you can get to your PayPal Business Account from anywhere.

Many entrepreneurs from other countries get in touch with Bizstartz for help with everything. First forming their LLC, then getting a U.S. bank account, EIN, helping with PayPal and Stripe verification, then everything else after that.

💡 Tips to Keep Your PayPal Account Balanced

Getting a PayPal account is one step, but for it to remain balanced, there are some things that need to be done first. Here are some things to avoid PayPal account limits:

Stick to Your Business Model

Make sure you accurately describe the business you are doing. Not doing so might lead PayPal to limit your account.

Be Sure to Have Business Email and Domain

A business website and a domain increases the trust PayPal has in your business.

Minimize Multiple Login Locations

PayPal scans account activity for odd logins. Use a reliable VPN that shares your business address region.

Do Not Mix Personal with Business Accounts

Do not ever combine account activities on PayPal. Keep all transactions, funds, and banking activities separate.

Do Not Keep Large Balances

Do not keep large PayPal account balances for a long time. Frequent withdrawals lower the chances of your account being flagged.

Be Timely with PayPal

If PayPal requests supporting docs, such as invoices, supplier details, and business proof, respond quickly.

Keep Business Docs Current

If your LLC address or ownership changes, be sure to keep PayPal updated to maintain compliance.

How Bizstartz Assists Non-U.S. Founders in Building and Operating U.S. Businesses

Bizstartz simplifies the process for non-U.S. entrepreneurs to legally establish and operate a U.S business, no U.S. travel required.

Here’s how we help:

LLC Formation in Any U.S. State: Delaware, Wyoming, Florida, Texas & more

EIN (Tax ID) Application: Fast EIN setup, even for non-U.S. residents

Registered Agent & Business Address: To receive U.S. mail and legal documents.

U.S. Bank Account Setup: Mercury, Relay, or Wise account for global founders

PayPal & Stripe Account Assistance: Guidance for smooth approval and compliance.

BOI Filing, Bookkeeping & Taxes: To help your LLC stay compliant year-round.

We handle all the paperwork, compliance, and setup, so you can focus on running and growing your business.

Final Thoughts

Being able to Create a U.S. PayPal Business Account with your LLC is one of the smartest steps you can take for scaling your business internationally. It allows you to receive payments from anywhere in the world, that increases trust from your clients, and makes you operate as though you’re a U.S. based company.

While the setup requires a few essential documents, LLC, EIN, address, and bank account, the rest is pretty straightforward.

PayPal is a vital tool for bridging the gap between your U.S. business and your international customers, no matter the type of business you have, whether it’s an eCommerce store, a freelance agency, a SaaS product, or a service-based company.

And since we have Bizstartz as your reliable partner, you won’t have to worry about complicated documentation or compliance, as we handle everything!

💼 Prepared to Make Your PayPal Business Account?

Begin the process by setting up your U.S. LLC with Bizstartz.

We will assist you with all aspects, including LLC registration, EIN, setting up your U.S. bank account, and activating your PayPal.

👉 Start with Bizstartz