Massachusetts is one of the most business-friendly states in the northeastern United States. It boasts a strong economy and a supportive legal framework. It is also a top state for tech, eCommerce, consulting, real estate, and service-based businesses.

However, when an entrepreneur forms an LLC, that is only the start. To keep the LLC active and in good standing with the state of Massachusetts, there is a host of compliance and state and federal filing requirements that the entrepreneur needs to understand and complete.

This guide applies to:

- U.S. residents, and

- Non-U.S. residents that remotely manage a U.S. LLC, and

- International entrepreneurs that utilize a Massachusetts LLC for running online businesses for Amazon, eCommerce, SaaS, marketing, consulting, etc.

This guide is intended to inform you of your obligations in the state of Massachusetts.

The guide covers annual filing requirements, dues, fees, tax classifications, and state obligations as we include our Bizstartz branded guidance as a business for founders to rely on for compliance support, bookkeeping, and tax filing support.

1. How Massachusetts LLCs Are Taxed: The Full Breakdown

Before we discuss annual filings, you need to understand some important facts about LLCs as business structures in the United States. An LLC is considered a flexible business structure, as the taxation of the LLC depends on how an entrepreneur has classified the business for tax purposes.

1.1 Default Federal Tax Classifications for LLCs

Single-Member LLC (SMLLC)

When you register an LLC with one owner, the IRS implies that the LLC is a disregarded entity, therefore:

- The LLC is not required to file a separate return.

- The owner needs to report the income earned on a personal return, either on Schedule C, E, or F, depending on the income type.

This represents the simplest tax setup, and is typical for:

- consultants,

- freelancers,

- eCommerce dropshippers,

- Amazon FBA sellers,

- SaaS founders, and

- international entrepreneurs.

Non-U.S. owners have a slight variation in income reporting rules, as they have to file a non-resident tax return.

Multi-Member LLC

If the LLC has 2 or more owners, the IRS requires that it is classified as a partnership, unless an alternative is elected.

This involves:

- Completing and filing Form 1065,

- issuing a Schedule K-1 for each member, and

- each member reporting the income on the personal tax return.

This structure works well for business partners, couple-owned companies, and U.S.-international joint ventures.

1.2 Optional Tax Classifications (Electing S-Corp or C-Corp)

LLCs have the option of choosing how they will be taxed by putting in the appropriate elections:

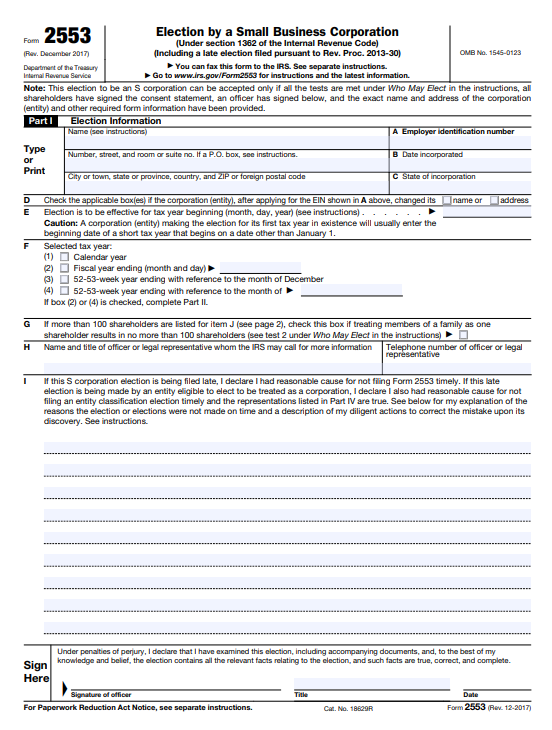

S Corporation (Form 2553)

Owners of LLCs tend to choose S-Corp taxation when the business starts to pull in 60k–100k of profit annually because it reduces self-employment tax by allowing to divide the income into:

- Salary (subject to taxes)

- Distribution (not taxed for self-employment)

Yet S-Corps need to account for:

- Managing payroll

- Managing accounting

- More complicated tax requirements

Bizstartz help founders determine if the S-Corp designation is beneficial for their business.

C Corporation (Form 8832)

Electing C-Corp taxation is less common for small businesses but useful for:

- Venture-backed companies

- Startups seeking investment

- Businesses reinvesting profits

C-Corps pay:

- 21% federal corporate tax

- Additional state corporate taxes

Then, owners pay taxes again on dividends, known as double taxation.

2. Annual State Filing Requirements for Massachusetts LLCs

Massachusetts requires several filings each year in order to keep your LLC active and compliant.

The two most important state requirements are:

- Annual Report Filing

- State Taxes based on your classification

Let’s go over each of them in more detail.

3. Massachusetts Annual Report: Detailed Requirements (Mandatory Every Year)

Every LLC that is registered in Massachusetts is obligated to submit an Annual Report through the Secretary of the Commonwealth.

3.1 What Is the Annual Report?

The Annual Report confirms or updates details such as();

- Legal name of the LLC

- Principal business address

- Manager/member information

- Registered Agent details

- Business activity description

Massachusetts uses this filing to verify that your LLC is still active and correctly configured.

3.2 Annual Report Fee and Deadline

- Fee: $500

- Due: Annually by your formation anniversary date

- How To File: Through the Secretary of State’s website.

The fee is significantly higher than in many states, which is why compliance is critical to avoid incurring reinstatement costs.

3.3 Consequences of Missing the Annual Report

Missing or delaying this filing can lead to the following:

❌ Loss of good standing

❌ Late filing penalties

❌ Administrative dissolution

❌ Loss of ability to open or maintain bank accounts

❌ Delays in tax filing and compliance

❌ Problems with payment processors like Stripe and PayPal

Bizstartz clients often rely on us to handle these filings automatically, ensuring no deadlines are missed.

4. Massachusetts State Taxes for LLCs: Full Overview

Massachusetts does not charge a general franchise tax like California or Delaware, but depending on your IRS classification, your LLC may be responsible for specific state-level taxes.

Let’s look at LLC type.

5. State Tax Obligations by LLC Classification

5.1 Single-Member LLC (Disregarded Entity)

In this case:

- This LLC does not pay state level income tax.

- The owner must report the income on his or her personal tax return in Massachusetts.

5.1.1 Personal Massachusetts Income Tax Rates

In Massachusetts, the income tax rates are as follows:

- 5% on most tax income

- 12% on short-term capital gains and certain interest income

If the owner does not live in Massachusetts, the income tax will depend on sourcing the income to Massachusetts.

For instance:

- Income derived from an online business that has no customers or employees in MA is usually not MA sourced.

- Nonetheless, real estate and business consulting, or even active business presence in Massachusetts, may result in tax obligations.

Bizstartz assists non-U.S. entrepreneurs in determining whether their actions create a Massachusetts tax nexus.

5.2 Multi-Member LLC (Partnership)

A Massachusetts multi-member LLC is required to file:

- MA Form 3 (Partnership Return)

Each full partner gets:

- Schedule K-1 (MA-NR)

- This K-1 is for filing Massachusetts individual tax return, if required.

Even if there is no MA-sourced income, the informational return still needs to be filed.

5.3 LLC Taxed as S-Corp

If you opt for S-Corp tax status for your LLC, you will owe and file the following in Massachusetts

- Form 355S.

- As for the taxes, you will owe

- 1) The Income Tax, 3%.

- 2) For the property/net worth, the excise is between 0.56% -2.75%.

If you S-Corp you will also

- Pay payroll taxes on salaries that they take as employees.

- Keep books and payroll.

- Issue W2 and 1099 forms.

For S-Corp clients, Bizstartz offers monthly payroll and bookkeeping services.

5.4 LLC Taxed as a C Corporation

In Massachusetts, if your LLC chooses C-Corp taxes, you will file

- MA Form 355.

- As for the corporate excise tax, you will owe

- 8% tax on income.

- $456 minimum excise tax, applicable even if there is no profit.

C-Corps also have to keep comprehensive records, and with our monthly bookkeeping services, Bizstartz can assist with that.

6. Federal Tax Filing Requirements for Massachusetts LLCs

As required by law, you must file federal tax returns with the IRS, regardless of your obligations in your home state. We expand on this below.

6.1 Single-Member LLC — Federal Obligations

As a single-member LLC, you must file as the sole owner of the LLC by using:

- Schedule C – Business income

- Schedule SE – Self-employment tax

- Schedule E or F (if applicable)

6.1.1 Self-Employment Tax

An owner must pay net profits of self-employment tax, which is 15.3%.

6.1.2 Non-US Resident Owners

A non-US owner must file:

- Form 1040-NR

- An ITIN may be required.

For international LLC owners, Bizstartz provides ITIN filing and federal tax preparation.

6.2 Multi-Member LLC — Federal Obligations

The LLC must file:

- Form 1065 (Partnership Return)

And then issue:

- Schedule K-1 to each member.

Each member must report their share of income on their federal return.

6.3 S Corporation LLC — Federal Obligations

An S-Corp must file:

- Form 1120-S

- And issue K-1 to the shareholders.

- Payroll must be run for owners who work in the business.

While this provides tax savings, it also increases compliance responsibilities.

6.4 C Corporation LLC — Federal Obligations

A C-Corp must file:

- Form 1120

- Pay 21% federal corporate tax

Dividends paid to owners are taxed again.

7. Sales Tax Requirements (If Applicable)

Your LLC is liable to collect and remit sales tax if you sell taxable goods and/or services in Massachusetts.

7.1 Sales Tax Rate

- 6.25% is the rate for the entire state.

7.2 Sales Tax Filing Frequency

Based on sales volume:

- Monthly

- Quarterly

- Annually

7.3 Massachusetts Sales Tax Applies TO

- Tangible products

- Certain digital goods

- Certain Software as a Service (SaaS)

- Rentals and/or leases

Bizstartz assists in determining nexus and applying for a Sales Tax Permit if needed.

8. Employer Tax Responsibilities (If You Hire Staff)

If you have employees in your LLC, the following is a list of mandatory obligations that are your responsibility:

8.1 Withholding Tax Registration

Businesses are required to register with MassTaxConnect to:

- Withhold state income tax

- File withholding tax returns

8.2 Unemployment Insurance (UI) Contributions

Paid to MA Department of Unemployment Assistance.

8.3 Workers’ Compensation Insurance

Required in most cases for all businesses.

8.4 Payroll Taxes

Filing with the IRS is required using:

- Form 941

- Form 940

- For employees, W-2 forms

- W-3 for the summary

Bizstartz provides payroll services for LLCs that are taxed as S Corporations or C Corporations.

9. BOI Filing Requirements (New 2024 Law)

As required under the Corporate Transparency Act, all US LLCs must file a BOI (Beneficial Ownership Information) Report with FinCEN.

9.1 When BOI Must Be Filed

- LLCs with a beginning date in 2024 must file within 30 days of your formation date.

- LLCs without a formation date of 2024 must file by January 1, 2025.

9.2 Updates

Updates to the BOI are only needed if:

- There are changes in ownership

- The address changes

- The identification document expires

- A member exits or joins

Bizstartz is responsible for BOI filing for all new and existing clients.

10. Deadlines Summary Table (Fully Expanded)

| Filing Requirement | Who Must File | Due Date | Fee |

| Annual Report | All MA LLCs | Anniversary date | $500 |

| Federal SMLLC Return | Single-member LLC | April 15 | Varies |

| Form 1065 | Multi-member LLC | March 15 | — |

| Form 1120-S | S-Corp LLC | March 15 | — |

| Form 1120 | C-Corp LLC | April 15 | — |

| MA Form 3 | Partnerships | March 15 | — |

| MA Form 355 or 355S | S-Corp / C-Corp | March 15 / April 15 | $456 minimum |

| Sales Tax Returns | Businesses with nexus | Monthly/Quarterly/Annually | — |

11. Penalties for Missing MA Tax or Annual Filings

This is the expanded list of the penalties.

11.1 Annual Report Penalties

- Loss of good standing status

- State penalties

- Dissolution of the business

- Fees for filing overdue reports

- Issues with banking and payment processing

11.2 State Tax Penalties

Massachusetts imposes the following for unpaid taxes:

- 1% interest/month

- Failure to file adds additional penalties

- severe penalties may include legal action

11.3 Federal Tax Penalties

The IRS imposes the following tax penalties:

- Failure to file

- Failure to pay

- Tax interest

- Incorrect returns

- Form 1065 penalties of $205 for each member for late submissions

12. Massachusetts Requirements for Non-U.S. Residents (Expanded)

Non-U.S. founders may:

- Form a Massachusetts LLC

- Be the sole owner

- No residency or citizenship is required

- Open U.S. bank accounts (if eligible)

- Conduct business worldwide

Tax obligations depend on:

- Whether the LLC has U.S. Effectively Connected Income

- The location of the customers

- Employment or presence physically in Massachusetts

- Taxable Sales

Additional things that may apply to Non-U.S. Owners include:

- An Individual Taxpayer Identification Number (ITIN)

- Beneficial Ownership Information (BOI) filing

- a Federal tax return

- Massachusetts informational return

Bizstartz specializes in compliance for foreign-owned LLCs, particularly in eCommerce, Amazon FBA, mentoring/coaching, SaaS, digital services, and marketing.

How Bizstartz Helps Massachusetts LLC Owners Stay Compliant

Massachusetts LLC Owners Entrepreneurs forming a business in the United States as a non-U.S. business founder worldwide tend to go to Bizstartz. Bizstartz is one of the first incorporation and compliance service providers.

For Massachusetts LLC Bizstartz offers:

- Bizstartz Massachusetts LLC formation

- EIN ( IRS)

- Registered Agent Service

- BOI filing ( FinCEN)

- Operating Agreement

Annual Compliance

- Annual Report filing

- State tax return filing

- Federal tax return preparation and filing

- Sales tax registration and filings

- Payroll setup

- Bookkeeping and accounting

International Support

- ITIN filing

- Bank account opening assistance

- Stripe, PayPal, Wise, Mercury support

- Amazon Seller approval support

We specialize in assisting you with the government requirements, compliance, and taxes so you can focus on growing your business.

Conclusion: Stay Compliant, Stay Protected, and Grow with Confidence

Massachusetts is a great state LLC but keeping compliant is not easy. You have to understand:

- Annual state filings

- Federal tax obligations

- Classification-based tax rules

- BOI obligations

- Sales tax and payroll requirements

Completing state filings late can disrupt your business, trigger penalties, or even cause total business dissolution. It can also disrupt your business, trigger penalties, or even cause total business to dissolve.

Missing deadlines can disrupt your business, trigger penalties, or even cause total business dissolution. Bizstartz helps entrepreneurs to stay fully compliant with zero stress, especially for non-U.S. founders.