Thinking of running a US LLC outside of the US? That’s likely what a lot of Wyoming, Delaware, and New Mexico LLC holders do. It’s likely you’ve completed the following steps:

- ✅ You’ve formed your LLC.

- ✅ You’ve obtained an IRS EIN.

- ✅ You’ve opened a US business bank account (Mercury, Relay, Wise, etc).

At this point you probably feel like you’ve completed the most difficult step. Now you need to open a US PayPal Business account to get paid by customers everywhere.

But then the confusion starts.

At this point, you may ask, “Do I need an ITIN to open a PayPal Business account? I have an EIN, isn’t that enough?”

Most people have to learn this too late: you can get a PayPal account with an EIN, but you can’t sustain the account long term without an ITIN. In this comprehensive guide, you will learn:

✓ Why you cannot use just your EIN for Paypal

✓ Why does Paypal freeze your account without an ITIN?

✓ What does the law say? (Patriot Act + IRS Reporting Rules)

✓ Why the vast majority of EIN-only “success stories” end in tragedy

✓ A bulletproof method for protecting your Paypal account

✓ If you want absolutely nothing to do with Paypal, here are the best alternatives

So, let’s jump right in.

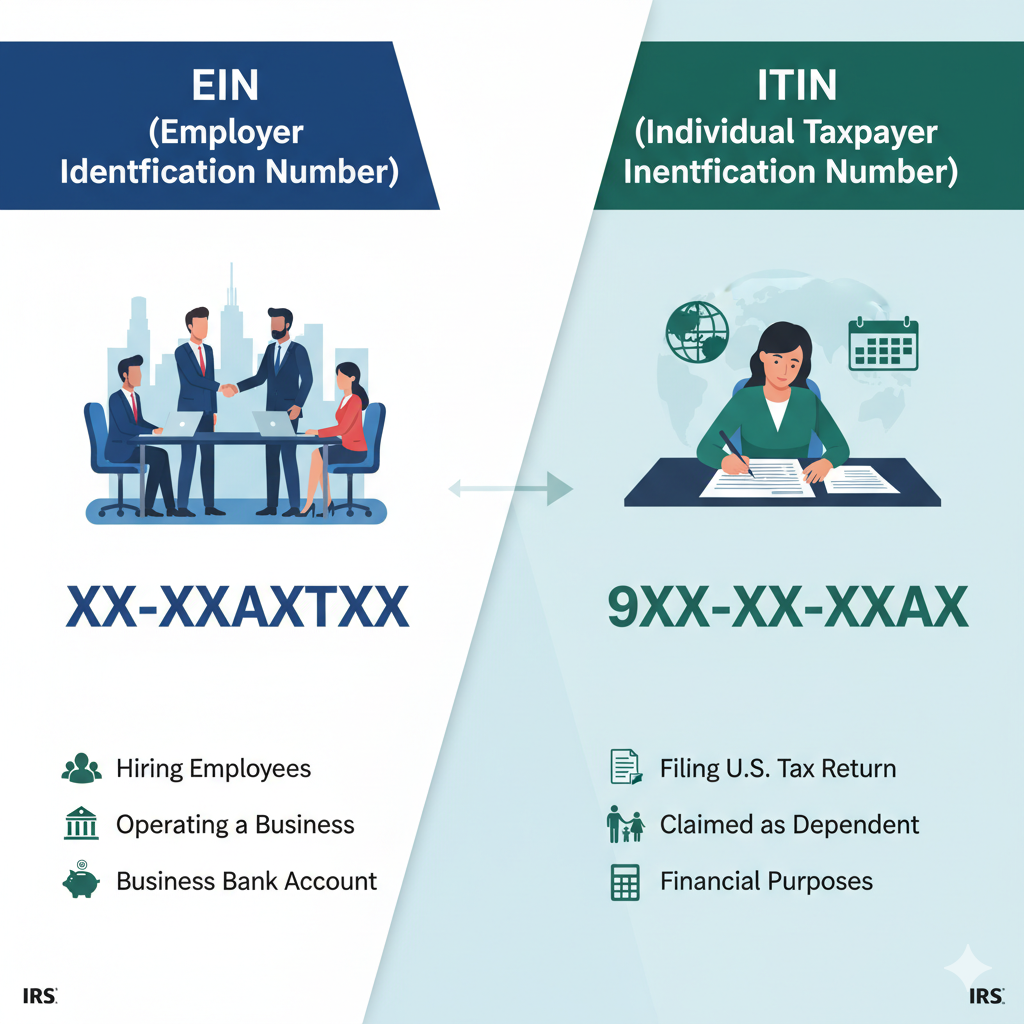

Difference Between EIN and ITIN, and Why Paypal Wants Both

Many international founders think that once they have an EIN, all USA financial systems will recognize them as a “validated business.”

This misconception accounts for 95% of PayPal account limitations for overseas business owners.

Here’s the full breakdown:

1. What EIN Actually Is (And Isn’t)

An Employer Identification Number (EIN) is:

- A tax ID provided to your LLC

- Required for federal business tax obligations

- Required to open business bank accounts

- Required to set up payment processors to receive business income

- The “SSN equivalent” for your business, not you

What EIN is not:

- Is NOT proof of identity of the owner

- Does NOT provide proof of the physical person behind the business

- Is NOT sufficient on its own for deep KYC verification

To summarize, your EIN is to verify your LLC exists, but you as a person do not.

2. What ITIN Is (And Why It’s Mandatory)

An Individual Taxpayer Identification Number (ITIN) is:

- A tax ID for foreign individuals

- Required for individuals who do not qualify for a Social Security Number (SSN)

- Mandatory for any personal-level IRS reporting

- A tax ID used by financial institutions to verify your identity

- A tax ID used by PayPal, Stripe, banks, and fintechs to comply with legal obligations to prove the beneficial owner is a verified, real person.

U.S. federal law (Patriot Act + AML rules) requires financial institutions to verify:

- Your identity

- Your country of residence

- Your tax compliance status

For non US founders, since you cannot provide an SSN the only substitute is the ITIN.

Why PayPal Cannot Rely on Your EIN Alone

Since an EIN is assigned to a business entity and not an individual, PayPal cannot ascertain:

- Who controls an LLC

- Who is the payment receiver

- Whether the user needs to report to the IRS

- Whether the user is on any sanctioned or restricted list

Therefore, all accounts must eventually KYC. This is why PayPal needs an SSN or Taxpayer Identification Number.

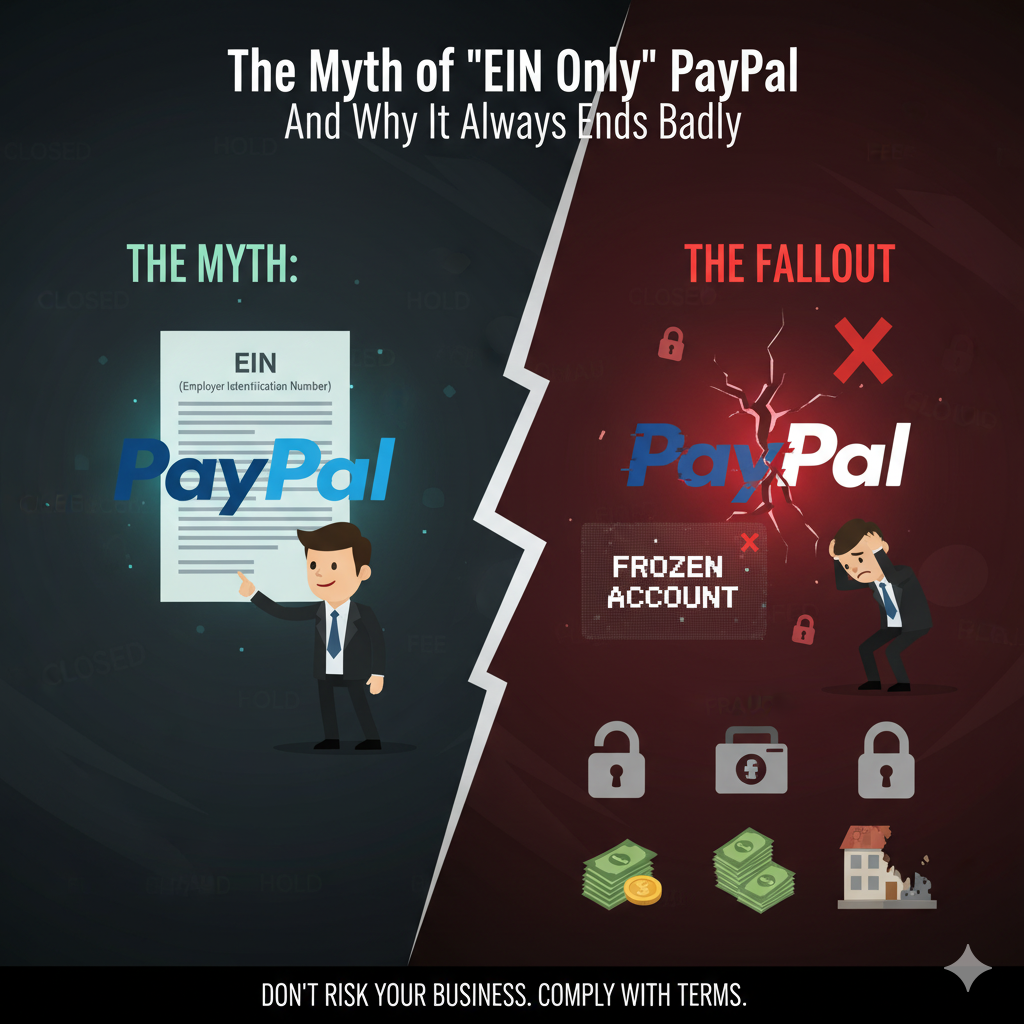

The Myth Of “EIN Only” PayPal And Why It Always Ends Badly

On multiple forums, social media platforms, and outdated blogs, it is common to see statements as below:

“I signed up for a Paypal US business account, and all I needed was an EIN. I did not need to provide an ITIN!”

In a technically correct, albeit a misleading way, they are completely skipping the ending of the story.

The Normal Life Cycle Of An EIN Only PayPal Account

Phase 1: Singing Up Successfully (Ascending False Security)

PayPal’s automated onboarding system enables you to key in the details of:

- Your business name

- Your EIN

- Your business address

- Your bank account

Everything is seamless and you think to yourself:

This is a walk in the park. All those cautions were far from the truth.

In the meantime, the internal risk score is likely to be on the rise unnoticed in the background.

Phase 2: First Few Deals (Entering A Rough Start)

Receipts of fund transfers are on the rise in your newly created account. Deals made can vary from a few hundred to a few thousand.

No alerts, limits, or notifications.

This part is a trap.

Phase 3: Enabled Constraints (This is where the actual work begins)

Eventually the PayPal accounts get the routine security review because of:

- High transaction volume

- Multiple withdrawals

- Logging in to a different country

- Customers filing disputes

- Random automated reviews

Then comes the mail you hate to see:

Your account has been limited. We need additional information to confirm your id.

They will request:

- A government-issued id (passport)

- Proof of address

- Business docs

- And Personal Tax Identification Number (SSN or ITIN)

This is where the EIN-only users get stuck.

Phase 4: Account Limitation + Funds Frozen

They try to provide the EIN but you can’t get past the form.

They need a personal tax id number. PayPal has made it clear they need a personal id number.

Without an ITIN you can’t complete verification.

So what happens? Permanent limitation.

Your money is frozen for 180 days.

You are unable to:

- Withdraw

- Transfer

- Access the balance

- Close the account

Because of this, the PayPal accounts where users have EIN-only accounts are called ‘ticking time bombs.’

Why has PayPal been more strict? The IRS Reporting Crackdown

PayPal likes limiting accounts as much as you enjoy it but they have to do it because of the us law.

IRS Rule: Form 1099-K Reporting

Because of IRS rules, payment processors such as PayPal MUST report your business income to the IRS using Form 1099-K.

In the past, reporting payments received was triggered if all of the following were true:

- $20,000 in payments AND

- 200+ transactions

However, the U.S. government has been tightening this reporting threshold.

New Reporting Reality:

- With the IRS now having a $600 threshold (which has been delayed several times, but this rule is coming soon).

- Many payment processors are already using a $5,000 or lower payment threshold triggers.

In order to file Form 1099-K, PayPal is required to have a verifiable tax ID for both:

- The Business (EIN)

- The Owner (SSN or ITIN)

If PayPal is required to file the report and they do not, they are breaking federal tax law.

However, PayPal is not willing to take that risk, and as a result, they freeze the account instead.

Fixing The Problem: The Definitive Action Plan for Non-US LLC Owners

If your priority is keeping your U.S. financial infrastructure compliant, your priority is to complete the steps below.

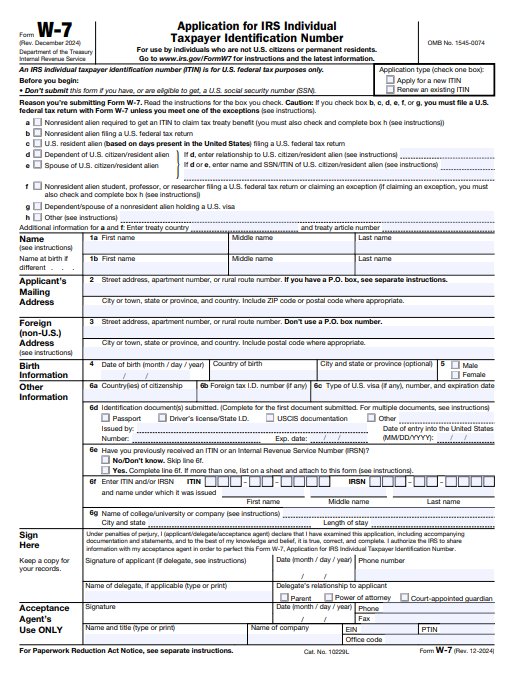

Step 1: Apply for an ITIN (Form W-7)

You can apply one of two ways:

Option A: The Hard Way (Not Recommended)

- Manually fill out Form W-7

- Mail this to the IRS

- Include your original passport

- Wait around 3-4 months

- Risk having your passport lost

Option B: The Secure and Fast Way (Recommended)

This is to use a Certifying Acceptance Agent (CAA).

CAA can:

- Verify your passport via Zoom/video call

- Submit applications on your behalf

- Eliminate mailing your passport

- Dramatically speed up the process

Bizstartz can link you with reliable CAAs if needed.

Step 2: Use the “Warm-Up Strategy” While Waiting

If you have to use PayPal before the ITIN comes:

- Open the account with your EIN

- Pull out funds daily

- Maintain low balances

- Do not leave funds stagnant in PayPal

- Do not make sudden large payments

You are buying time—not stability.

Step 3: Update PayPal When You Get the ITIN

When PayPal asks for verification:

- ITIN

- Passport

- Address proof

- LLC docs

Boom! Your account is fully verified and free from arbitrary limits.

Are There Alternatives to PayPal? (Yes, But With Conditions)

PayPal is notorious for having aggressive limitations for international owners.

If you want more stability, you can consider:

1. Stripe

- Best for non-US founders

- Fast onboarding

- Accepts passport + EIN

They may ask for the ITIN later, but not until much later than PayPal.

2. Paddle (Merchant of Record)

- They handle sales tax, VAT, fraud, and chargebacks

- Much easier onboarding

- Slightly higher fees

- No need for your own merchant setup

3. Payoneer

- Works well for international founders

- Good for marketplace payouts

- Less strict than PayPal

Final Verdict: Can You Open a PayPal Account with Just an EIN? Yes.

Should You? Absolutely Not.

The EIN-only method is not a “hack,” nor is it a shortcut. It’s a temporary loophole that will eventually:

- Freeze your account.

- Lock your business.

- Hold your funds for 6 months.

- Damage your customers’ trust.

If you are serious about building a long-term U.S. business, treat the ITIN as a standard and unavoidable requirement—not an optional upgrade.

Success in U.S. business compliance is simple:

- Follow the law.

- Meet IRS requirements.

- Verify your identity properly.

- Protect your money.

If you need help with your ITIN application, PayPal setup, or U.S. LLC compliance, Bizstartz can guide you step-by-step and ensure your business stays compliant and secure.