Are you a non-US resident with a US Limited Liability Company (LLC)? Do you find yourself dealing with the intricate world of US taxes? Do not worry, you are not the only one. The good news? Simply owning a US LLC does not mean you owe US income taxes.

As a non-resident, the US taxes you owe rely on where your income is received, not where your LLC is registered. Below are some key concepts every non-resident LLC owner should know in order to legally eliminate or minimize your US income tax exposure.

🚨 Disclaimer: This article is for informational purposes only and does not constitutes tax or legal advice. International tax law is complicated. You should consult with a qualified US international tax professional to achieve compliance and properly structure your business.

🔑 The Core Concept: Effectively Connected Income (ECI)

If you are a non-resident LLC owner, the single most critical factor determining your US income tax exposure is whether your income is considered Effectively Connected Income (ECI).

Remember: non-resident aliens (NRAs) are only taxed on income that is Effectively Connected with a U.S. Trade or Business (ETBUS).

What Exactly Is a U.S. Trade or Business (ETBUS)?

Your LLC is considered engaged in U.S. trade or business if you have:

- 1. A dependent agent (e.g. an employee or an independent contractor) who is physically present in the United States, AND

- 2. That dependent agent performs services that are, or are expected to be, a material contributor to the LLC’s income.

How to Avoid ETBUS and ECI:

The primary strategy to avoid U.S. income tax is to ensure your business activities do not meet the ETBUS definition. This means:

- No U.S. Physical Presence: do not have an office or a fixed place of business in the United States

- No U.S. Employees: do not hire employees in the United States

- No Dependent Agents: make sure that any contractors or third-party service providers in the U.S. are genuinely independent agents (which has a legal definition and requires careful structuring to avoid penalties)

- Location of Services: you, the non-resident owner, should perform the income-producing activity (e.g. selling digital products, remote consulting, etc.) entirely outside the United States.

Example: Owning a U.S. LLC while a resident in France and selling digital courses globally, with all course development and competencies from France, in most situations will not have ECI and thus will not pay U.S. taxes.

🗺️ Using U.S. Tax Treaties

If you live in a country with a U.S. income tax treaty (more than 65 countries), you may get further protection.

Tax treaties may overrule the statutory ECI rules stating that U.S. business income is only taxable if you have a “Permanent Establishment” (PE) in the United States. The definition of a PE is frequently more restrictive than the IRS’s ETBUS rule, thus providing more comfort on no U.S. tax liability.

What you should do: Speak with a tax advisor regarding the applicable Business Profits Article from the tax treaty between your country and the U.S.

📑 Knowing your Filing Requirements (even if you owe $0 tax)

Importantly, just because you will not owe tax to the United States does not mean you do not have copies of taxpayer returns that must be filed.

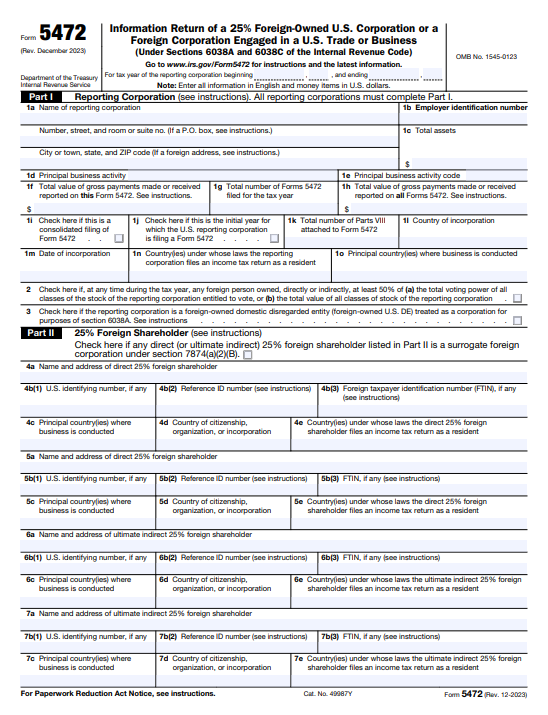

1. The Single-Member LLC Trap: Form 5472

A U.S. Single-Member LLC (SMLLC) owned by a non-resident alien is, most times, a “disregarded entity” for tax reason.

- Form 5472 (Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business):

- This form, filed along with a Pro Forma Form 1120, is an annual requirement for your LLC to report transactions with its foreign owner (e.g., capital contributions, withdrawals).

- This form is required even if the LLC has no income or no ECI.

- Penalty for Failure to File: The minimum penalty for failure to file or filing an incorrect Form 5472 is a staggering $25,000.

2. Case of Multi Member LLCs, Form 1065 and Schedule K- 1

If the LLC has several partners, each of whom is a foreign entity, the IRS regards that as a Partnership.

- In that case, the LLC is required to file the US tax return 1065 which is the US return of Partnership income .

- The K – 1 tax Schedule must also be issued to the partners to account for their individual income share which must be included in the personal tax return.

- Also, if the Partnership has effectively connected income ( ECI), then the foreign partners will be subjected to withholding income requirements as per Forms 8804 and 8805.

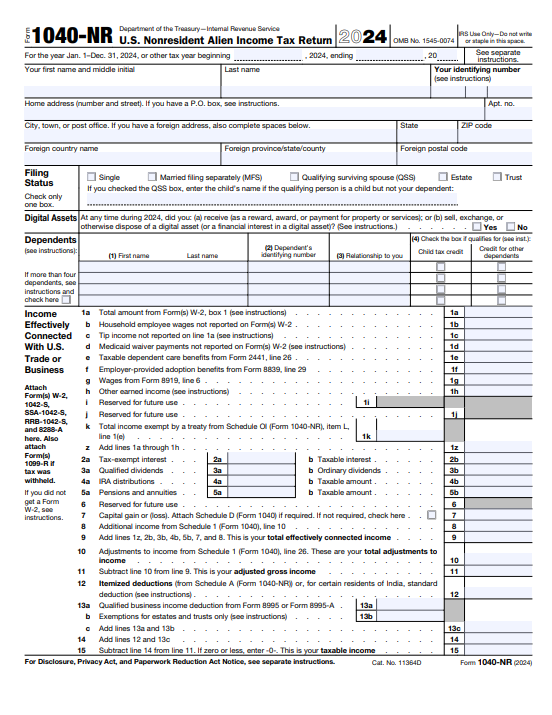

3. Personal Income Tax Return 1040-NR

In the case that your LLC is making money and the income is considered to be effectively connected income (ECI), then you, as the foreign owner, are required to submit form 1040-NR (U.S. Nonresident Alien Income Tax Return) and must pay taxes on that income.

Taxes must be paid at the U.S. progressive rate too. Additionally, you will need to get an Individual Taxpayer Identification Number (ITIN) prior to submitting this form.

✅ Summary of the Tax-Free Strategy

To have a US LLC but legally pay $0 US income tax on your profits, you must ensure the following are true:

| Condition | Description |

| 1. No ECI | Your LLC is not engaged in a U.S. Trade or Business (ETBUS). All income-generating services are performed outside the U.S., and you have no dependent agents in the U.S. |

| 2. Passive Income | If the income is passive (e.g., real estate rental), ensure proper withholding compliance for FDAP (Fixed, Determinable, Annual, or Periodical) income. |

| 3. Treaty Benefit | (Optional but helpful) You can leverage an applicable US tax treaty to confirm that your business lacks a Permanent Establishment (PE) in the U.S. |

📌 Next Steps: Don’t Risk the Penalties

The premise of No ETBUS = No ECI = No US Income Tax seems simple, yet, the reporting requirements for this premise are extensive. Simply ignoring these forms, even if you owe no tax, can create huge penalties.

Therefore, your next step is to:

Consult a U.S. International Tax CPA: It is essential you get a tax professional to make sure that you get all structure your business properly and that you get all the necessary forms and documentation filed by the due dates, as the requirements for reporting are strict, with no exceptions.

How Bizstartz can help?

Bizstartz, as a business formation and compliance service, helps non-resident LLC owners satisfy their annual U.S. tax reporting obligations (not necessarily tax payment) by concentrating on the complex informational forms that the IRS requires.

Their help usually falls within three waters that most outsiders do not understand:

Preparation and Filing of Form 5472

This is the most important and most dangerous form of filing from the perspective of penalties for a non-resident owner of a Single Member LLC (SMLLC).

The compliance requirement: A single-member LLC is considered a “disregarded entity” by default for tax purposes.

However, the IRS considers it a corporation, but for reporting purposes only under IRC 6038A. This requires that Form 5472 (Information Return of a 25% Foreign-Owned U.S. Corporation or Foreign Corporation Engaged in a U.S. Trade or Business) be filed annually.

Bizstartz’s Contributions: Bizstartz’s contractors help with the completing and filing of the timely due:

- Pro Forma Form 1120: Filing a blank or pro forma (fake) U.S. Corporation Income Tax Return with the legend written across the top “Foreign-owned U.S. DE” as the cover sheet.

- Form 5472: Filling out Form 5472 and attaching it, which is a form that reports “reportable transactions” (like capital contributions and withdrawals) that occur between the LLC and its foreign owner.

Avoiding penalties: By doing all the precise and mandatory filing due annually, the service saves the non-resident from the filing of Form 5472 which comes with an unduly harsh (but automatic) minimum penalty of $25,000 for failure to file.