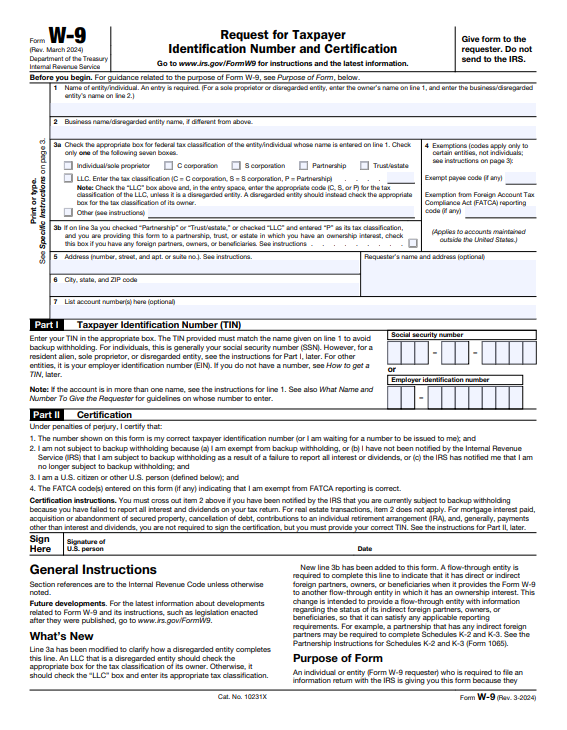

Form W-9, officially known as “Request for Taxpayer Identification Number and Certification,” is a foundational document in the U.S. tax system. Despite being only one page long, it plays a critical role in tax compliance, payment reporting, and financial transparency between businesses and individuals.

Many entrepreneurs, freelancers, and even established companies underestimate the importance of Form W-9, often filling it out incorrectly or misunderstanding when and why it is required.

This comprehensive guide breaks down everything you need to know about Form W-9, including its purpose, legal implications, step-by-step completion instructions, and common pitfalls to avoid.

What Is Form W-9?

Form W-9 is an information-request form used by businesses to collect accurate taxpayer details from U.S. persons or entities they pay. The information collected on Form W-9 allows the payer to correctly report payments to the Internal Revenue Service (IRS).

Unlike many IRS forms:

-

Form W-9 does not calculate taxes

-

It does not require payment

-

It is not filed with the IRS by the person completing it

Instead, the completed W-9 is kept by the requester and used to prepare information returns, such as Form 1099-NEC or Form 1099-MISC.

Why the IRS Requires Form W-9

The IRS uses the data indirectly to:

-

Track income paid to individuals and businesses

-

Match reported income with tax returns

-

Prevent tax evasion and underreporting

Who Needs to Fill Out Form W-9?

Form W-9 must be completed by U.S. persons who receive reportable income. A “U.S. person” includes more than just U.S. citizens.

Individuals and Entities Required to Submit Form W-9

-

U.S. citizens and green card holders

-

U.S. residents for tax purposes

-

Freelancers and independent contractors

-

Consultants and service providers

-

Single-member LLC owners

-

Multi-member LLCs

-

Partnerships

-

S-Corporations and C-Corporations

-

Trusts and estates formed in the U.S.

Non-US Founders with U.S. LLCs

If you are a non-US resident who owns a U.S.-registered LLC, the LLC itself is considered a U.S. entity. In most cases, the LLC will still provide Form W-9, not Form W-8, when dealing with U.S. clients, banks, or platforms.

When Is Form W-9 Required?

Form W-9 is generally requested before payments are issued. It ensures that the payer has correct information on file before reporting income.

Common Situations Where W-9 Is Required

-

You are paid $600 or more in a calendar year for services

-

A company needs to issue you a Form 1099-NEC

-

You open a U.S. business bank account

-

You register with Stripe, PayPal, Amazon, Etsy, or Shopify Payments

-

You receive rental income, referral income, or commissions

-

A business needs to confirm your tax residency status

Failing to provide a W-9 when requested can lead to administrative delays and withholding issues.

What Information Is Included on Form W-9?

Each section of Form W-9 serves a specific compliance purpose. Filling it out accurately is essential.

Line 1: Name (Legal Name)

This must match the name used on your federal tax return.

-

Individuals → Personal legal name

-

Single-member LLCs → Owner’s legal name

-

Corporations or partnerships → Entity’s legal name

Using a nickname, brand name, or incorrect spelling can cause mismatches in IRS records.

Line 2: Business Name / Disregarded Entity Name

This line is used for:

-

LLC names

-

DBAs (Doing Business As)

-

Trade names

If you operate under a business name different from your legal name, list it here.

Line 3: Federal Tax Classification

Selecting the correct tax classification is one of the most critical parts of Form W-9.

Options include:

-

Individual / Sole Proprietor

-

Single-Member LLC (Disregarded Entity)

-

Partnership

-

C-Corporation

-

S-Corporation

-

Trust / Estate

Incorrect classification can result in:

-

Wrong 1099 forms

-

IRS notices

-

Backup withholding

Line 4: Exemptions

This section applies mainly to:

-

Certain corporations

-

Government entities

-

Tax-exempt organizations

Most individuals, freelancers, and LLC owners leave this blank.

Lines 5 & 6: Address

Enter your current mailing address where tax forms (such as Form 1099) should be sent. This does not need to be a U.S. address, but it must be accurate and up to date.

Line 7: Account Numbers (Optional)

Only complete this if the requester specifically asks for account reference numbers.

Part I: Taxpayer Identification Number (TIN)

You must provide one valid TIN:

-

SSN → Individuals and sole proprietors

-

EIN → LLCs, partnerships, corporations

Providing the wrong number is one of the most common reasons for IRS mismatches.

Part II: Certification and Signature

By signing Form W-9, you legally certify that:

-

The TIN provided is correct

-

You are not subject to backup withholding (unless indicated)

-

You are a U.S. person for tax purposes

An unsigned W-9 is considered invalid.

Form W-9 vs Form W-8: Key Differences Explained

Many international founders confuse these two forms.

| Feature | Form W-9 | Form W-8 |

|---|---|---|

| Used by | U.S. persons/entities | Non-U.S. persons/entities |

| Purpose | Provides SSN/EIN | Certifies foreign status |

| Tax reporting | 1099 forms | FATCA & withholding |

| Common users | LLCs, freelancers | Foreign individuals |

If your business is a U.S. LLC, you almost always use Form W-9, even if the owner lives abroad.

Is Form W-9 Safe to Share?

Form W-9 contains sensitive data, so caution is essential.

Best Practices for Sharing W-9

-

Share only with verified businesses

-

Avoid public file-sharing links

-

Use encrypted email or secure portals

-

Do not upload to unknown platforms

Never post your W-9 publicly or send it through unsecured messaging apps.

Common Mistakes to Avoid on Form W-9

-

Listing the LLC name on Line 1 instead of the owner’s name

-

Choosing the wrong tax classification

-

Entering an outdated EIN or SSN

-

Forgetting to sign and date the form

-

Using Form W-9 when Form W-8 is required

Even small errors can trigger IRS notices or payment issues.

What Happens If You Don’t Provide a Form W-9?

Failure to submit a valid W-9 can result in serious consequences:

-

24% backup withholding on payments

-

Delayed or canceled payments

-

Inability to receive 1099 forms

-

Potential IRS penalties

Backup withholding remains in effect until a correct W-9 is provided.

Do You Need Professional Help with Form W-9?

For freelancers and U.S. citizens, Form W-9 is usually straightforward. However, for:

-

Non-US founders

-

Multi-member LLCs

-

Businesses using payment processors

-

Companies operating internationally

Professional guidance can prevent costly compliance mistakes.

Final Thoughts

Form W-9 is a cornerstone of U.S. tax compliance. While it may appear simple, its accuracy directly impacts how income is reported, how payments are processed, and how the IRS views your business.

Understanding Form W-9, and completing it correctly, helps protect you from withholding issues, IRS notices, and administrative delays. For anyone doing business in the United States, mastering this form is not optional, it’s essential.

Contact Bizstartz to file your Form W-9 today.