The Most Complete Compliance Guide for U.S. and International Founders with a California LLC

California has a strong and diverse economy. It has a lot of entertainment, technology, corporate headquarters, services, creative industries, wellness, and Silicon Valley. There are a lot of entrepreneurs and technology companies.

Because of this economic activity, California has the most highly structured and complex tax filing requirements of any state for LLC owners.

California has a rigid set of yearly obligations whether you are a U.S. based founder or a Non-U.S. resident forming a California LLC.

You cannot file or file properly and incur fines, lose the ability to legally do business, have business status “grounded’, lose business financial access and get legally threatened.

This guide by Bizstartz explains, founder friendly but thorough and detailed – the what you have to file for a California LLC, the why, the when, the cost, the examples, the compliance.

1. Understand California LLC Annual Requirements

There is a lot involved with running a California LLC once it is formed, and there is formation running. Each year there are 3 core of these obligations for all LLCs, and they are a three.

1. California Franchise Tax ($800 Minimum Tax)

This is an income tax levied on most LLCs registered or doing business within the state, and it cannot be avoided.

2. LLC Income Tax Return (Form 568)

This tax return encompasses your LLC’s income, your deductions, revenues sourced from California, members, and taxes owed.

3. Statement of Information (Form LLC-12)

This is a business update report that is filed every 2 years, however, is required to be filed within 90 days of formation at first.

On top of these, there may be:

- Sales tax obligations

- Payroll tax filings

- Renewals of business licenses at the city level

- More franchise taxes if revenue exceeds certain limits

- Federal tax returns

California is strict concerning compliance through the Franchise Tax Board (FTB), Secretary of State (SOS), and California Department of Tax and Fee Administration (CDTFA). It is good to know these obligations.

2. California Franchise Tax – $800 Annual Minimum

(Most Important Requirement for All LLCs)

The California Franchise Tax is the most fundamental annual requirement for LLCs. Almost every LLC has to pay $800 a year, no matter if there is:

- Income

- Loss

- No activity

- Inactive LLC

- LLC was formed late in the year

- LLC has not started operations yet

California will consider the LLC to be “active” the moment you have formed it legally, not when you begin doing business.

2.1 Why Does California Charge the $800 Minimum Tax?

The $800 isn’t an income tax. It is a privilege tax for being allowed to do business in California.

The tax is required even if the LLC does not earn any revenue or profit because the LLC is a legally protected business entity.

2.2 Who Must Pay the Franchise Tax?

The following must pay:

- California domestic LLCs

- Foreign LLCs registered to operate in California

- LLCs physically operating in California

- LLCs selling or servicing customers in California

- California LLCs owned by non-U.S. citizens

If your LLC is “doing business” in California, even from outside the state, you must pay.

Here are some examples of “conducting business”:

- Employing individuals located in California

- Operating a CA based physical location or storing goods in a CA based warehouse

- Selling goods or services to CA based customers

- Offering services to a business located in California

- Having a virtual California based office or presence

- Contracting workers from California

- Keeping business funds in California

2.3 When Is The $800 Franchise Tax Due?

First Tax Year

Tax payment is due on or before the 15th of the 4th month after the formation of the LLC.

For example, assuming your LLC formation is on July 20. Tax payment due date will be on November 15.

Subsequent Years

- Tax payment is due every year on or before April 15

2.4 What Happens if You Don’t Pay the Franchise Tax?

California imposes:

- Penalties

- Interest, compounded daily

- Your LLC may be suspended

- You may lose your limited liability protection

- Your business bank account may be frozen

- You may be prohibited from operating your business legally

If your LLC is suspended you may not:

- Contract

- Enforce contracts

- Exercise legal rights

- Sue

- Claim a tax refund

- Obtain permits

- Renew licenses

- Maintain any legal protection

We strongly suggest that you schedule this tax payment every year, or if you prefer, you may instruct us to take care of compliance on your behalf.

3. Statement of Information (Form LLC-12)

(A Mandatory Secretary of State Filing)

The Statement of Information is California’s way of keeping your business details updated. You must file it:

- Within 90 days of forming the LLC

- Every 2 years after that

This applies whether your LLC has one owner, multiple owners, or is owned by a non-U.S. resident.

3.1 What Information Does LLC-12 Require?

The form includes:

- Legal business name

- Business address

- Mailing address

- Management structure (manager-managed or member-managed)

- Names and addresses of managers or members

- Registered agent information

- Business activity description

3.2 Fee and Timeline

- Filing fee: $20

- Due: Every two years (biennial)

- Late penalty: $250

If you dont file, the Secretary of State can shut down your LLC, and you can also get penalties from the Franchise Tax Board even.

3.3 Who Must File It?

All LLCs:

- California domestic LLCs

- Foreign LLCs registered in California

- LLCs owned by Non-U.S. persons

- LLCs with no income

- Inactive LLCs

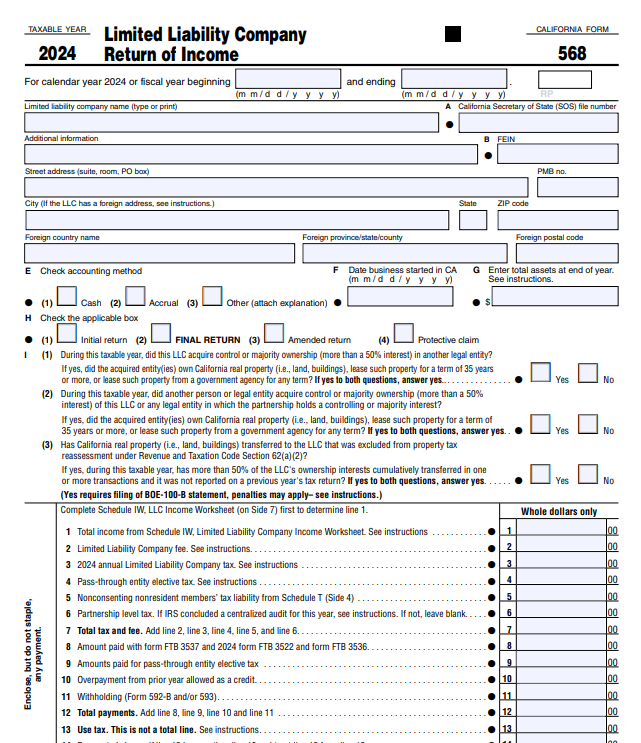

4. Annual California LLC Income Tax Return (Form 568)

Most Detailed Tax Filing for California LLCs

Form 568 is California’s annual LLC tax return. It is a report on the LLC’s:

- Income

- Losses

- Expenses

- Members

- Allocation of California-source income

- Taxes and fees owed

- Gross receipts fee (if applicable)

You will need to file Form 568 even if your LLC had no income.

4.1 Who Must file Form 568?

You are required to file if:

- You formed your LLC in California

- You registered your LLC to conduct business in California

- You LLC is actively doing business in California

- You are the Non-U.S. owner of a California LLC

- You received income from customers in California

4.2. Purpose of Form 568

Form 568 has several purposes:

- Determine amount of tax that is owed by the LLC

- Confirm the level of activity of the LLC

- Confirm payment of the $800 franchise tax

- Determine if the gross receipts fee is applicable

- Correct the amount of allocated distributions

- Adjust taxation on non-resident members

Form 568 is especially important for Non-U.S. founders because released income allocated to foreign owners is heavily scrutinized.

4.3 Due Date of Form 568

- Due every year on April 15.

- Extensions are available, but tax payments must still be made on time

If the return is late, California charges a per-member penalty.

5. California LLC Gross Receipts Fee

(Additional Annual Fee Based on California-Sourced Revenue)

As an LLC earns over $250,000 in CA-sourced revenue, you will incur a Gross Receipts Fee.

This fee applies even if total revenue is significant, but profits are minimal.

Examples of California-Sourced Income:

- Sales to customers in California

- Services offered to companies in California

- Contracts based in California

- Business activities performed in California

5.1 Fee Structure

| CA Revenue Range | LLC Fee |

| $250,000–499,999 | $900 |

| $500,000–999,999 | $2,500 |

| $1,000,000–4,999,999 | $6,000 |

| $5,000,000+ | $11,790 |

This is different from the $800 franchise tax.

5.2 When Must the Gross Receipts Fee Be Paid?

With the filing of Form 568, Gross Receipts Fee is paid.

6. Sales Tax Requirements (CDTFA)

(For LLCs Selling Products or Taxable Digital Goods)

For LLCs selling physical merchandise or taxable digital commodities, California mandates:

- To obtain a Seller’s Permit from CDTFA

- To collect the sales tax from the customers

- To submit regular sales tax returns

Depending on sales, you may file:

- Monthly

- Quarterly

- Yearly

Bizstartz can assist with setting up CDTFA accounts for sellers outside the U.S.

7. Payroll Tax Responsibilities (When You Have Employees)

(California Has Complicated Payroll Regulations)

When your LLC has employees, you need to:

- Register with the Employment Development Department (EDD)

- Withhold employee taxes

- Pay for unemployment insurance

- Submit payroll returns every quarter

Remote employees and contractors are the ones California audits for payroll filings the most.

8. Local Business License and City Tax

Depending on your LLCs location, you may need to do the following:

- Business License Renewals

- Local Tax Filings

- Zoning Compliance

Examples:

- Los Angeles: Business Tax (annually)

- San Francisco: Business Registration Fee + Gross Receipts Tax

Many online-only businesses are required to register as well.

9. Federal Tax Filing Requirements of California LLCs

Your federal requirements are based on how your LLC is organized.

9.1 Single-Member LLC (SMLLC)

(Default Classification with the IRS)

If the owner is from the U.S. → Taxed as a disregarded entity.

If the owner is not from the U.S. → Foreign-owned SMLLC regulations apply.

U.S. Owners Submit:

- 1040 Form Schedule C

Non-U.S. Owners Submit:

- Pro Forma 1120 + 5472

This is a required submission for disregarded entities that are foreign-owned.

9.2 Multi-Member LLC

Multi-member LLCs fill out

- IRS Form 1065

- Each member will also receive a K-1 tax form

Foreign business partners must also fill out

- Form W-8BEN

- Form 1040-NR (if there are income sources in the U.S.)

9.3 S-Corp Election

If your LLC elects to be S-Corp:

- Form 1120-S must be submitted.

- Business owners must receive a reasonable income.

- Rules regarding payroll taxes will also apply.

Bizstartz assists in determining if the S-Corp elections are beneficial for California-based enterprises (most of the time they are not because CA still assesses taxes on LLCs).

10. Penalties and Consequences for Missing Filings

California has to be the most strict.

10.1 Franchise Tax Penalties

- Incurs interest for late payments

- Eventually LLC suspension will occur

10.2 Form 568 Penalties

- $18 per month, per member for a maximum of 12 months.

10.3 Statement of Information Penalties

- $250 late fee

- Business could also be suspended

10.4 Suspension Consequences

If an LLC is suspended, it means:

- They cannot operate legally

- Restrained from legal action

- Cannot renew any licenses

- Cannot open bank accounts

- May lose liability protection

Bizstartz can restore suspended LLCs through SOS + FTB reinstatement.

11. Annual Checklist for California LLC Owners

(Bizstartz recommends compliance calendar)

Every year:

- Pay $800 Franchise Tax

- Submit Form 568

- Pay gross receipts fee (if applicable)

- Renew City Business Licenses

- Submit Sales Tax Returns

- Submit Federal Taxes

- Maintain Bookkeeping

Every two years:

- Submit Statement of Information (LLC-12)

Throughout the year:

- Update Registered Agent

- Update Business Addresses

- Maintain Accurate Records

- Retain Compliance Documents

12. How Bizstartz Help CA LLC Owners

For Bizstartz, compliance tasks for international and U.S. founders are managed as a whole.

Our services include:

- Complete California Annual Compliance

- Filing of Franchise Tax Annually

- Preparation of Form 568

- Submission of Form 5472 for Non-U.S. Owners

- BOI Submission

- Registered Agent

- Bookkeeping and Accounting in the U.S.

- Setup of Payroll

- Sales Tax Setup

- Compliance in Multiple States

- Formation of LLC and Issuance of EIN

We make sure your LLC is fully compliant in:

- IRS

- California Franchise Tax Board

- Secretary of State

- CDTFA

- Local County/City Authorities