Maryland has one of the most robust economies along the Eastern Seaboard, due in large part to an educated workforce, accessible regulatory policies, proximity to the capital, and proximity to the capital. These are all major benefits of operating a Maryland LLC.

Of course, once the LLC is formed, there are many compliance issues that the LLC owner needs to understand to avoid penalties, including:

- Annual state filing compliance

- Other tax compliance

- Federal obligations

- Ongoing compliance

This guide covers every Maryland LLC owner’s annual tax liabilities, including:

- Pass-through taxation

- Franchise tax

- Personal taxation obligations

- Non-residents’ requirements when operating an LLC in Maryland

1. Overview of Taxation for a Maryland LLC

Importantly, Maryland LLCs are considered to be pass-through entities. This means:

- An LLC does not, as a business entity, pay income tax;

- Any profits are distributed to the members (owners); and.

- Each owner is then responsible for tax payments on their portion of the income, which is ultimately reported as part of their personal income tax filings (or corporate filings, if applicable).

Unlike most other states, Maryland has the following requirements:

✅ Each LLC must submit an Annual Report

✅ Each LLC must submit a Personal Property Tax Return (if applicable)

✅ Each member must file a State Income Tax Return (if they live in Maryland or have MD-sourced income)

✅ Each member must submit Federal Tax Returns

✅ Employer filings (if applicable)

Maryland LLC requirements must be complied with by all U.S. residents and foreign business owners to avoid penalties and/or loss of good standing and avoid administrative dissolution.

2. Annual Report in Maryland (All LLCs must file)

Every LLC in the State of Maryland must file Annual Reports with the Maryland Department of Assessments and Taxation (SDAT).

Due Date:

Every year by April 15 .

Annual Report Filing Costs:

It is $300 to file the Annual Report.

Annual Report Includes:

The Annual Report confirms:

- Business address

- Registered agent information

- Member or manager information

- Confirmation of business activity

- Total gross sales reported in Maryland

How to file:

- 1. Use the Maryland Business Express Portal. (OPTION PREFERRED)

- 2. Fill out a Report and submit it by paper email. (OPTION NOT PREFERRED DUE TO DELAYS)

Penalties for Late Filing:

- Loss of good standing

- Additional fees

- Risk of LLC forfeiture by the state

Once forfeited, the company cannot operate legally or file documents and must be reinstated to do so.

3. Maryland Personal Property Tax Return

(Required for various LLCs)

If your LLC possesses, leases, or utilizes personal property in Maryland — like:

- Office furniture

- Equipment

- Computers

- Machinery

- Tools

- Inventory

— you must submit a Personal Property Tax Return along with the Annual Report.

Due Date:

Also on April 15.

Filing Fee:

Part of the $300 annual report fee.

If the LLC Has No Personal Property?

You only submit the Annual Report omitting the property return.

Penalty for Not Filing When Required:

- Higher tax assessment

- More penalties

- No good standing

4. Maryland State Income Tax for LLC Members

Since LLCs have a pass-through tax structure, owners’ personal tax compliance depends on their state of residence.

a) Maryland Residents (U.S. citizens or residents)

If you reside in Maryland, you have to file state income tax on all income earned through the LLC, regardless of whether it was earned in Maryland.

b) Non-Residents (Living in another U.S. state)

You must file a Maryland non-resident income tax return for Maryland-sourced income only.

c) International (Non-U.S. Residents)

If you are an international founder operating a Maryland LLC from another country:

- Your LLC’s income will likely be considered foreign-sourced, meaning you won’t have to pay any Maryland personal income tax, provided the LLC does not have any office, employees, or physical presence in the U.S.

- If your LLC does have Maryland-sourced income (customers, operations, warehouse, etc.), you must file Maryland non-resident tax returns.

Maryland Individual Tax Forms:

- Form 502 (resident)

- Form 505 (non-resident)

- Pass-through entity K-1 documents

5. Maryland Pass-Through Entity Tax (PTE Tax)

Maryland allows LLCs to elect to pay Pass-Through Entity (PTE) Tax on behalf of their members.

This can help members claim a credit on their personal tax returns and reduce the impact of the federal SALT cap limitation.

PTE Tax Is Useful If:

- The LLC has high income

- Members want the LLC to pay the tax instead of paying individually

- Members want to maximize deductible tax payments

Filing Requirements:

- Form 510

- Form 511 (PTE tax return, if applicable)

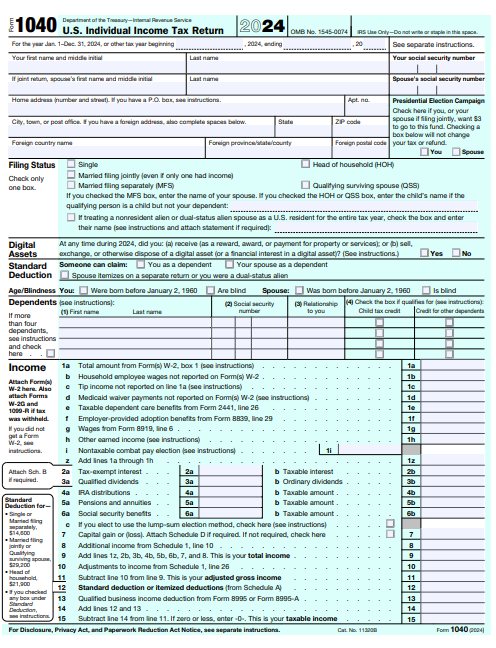

6. Federal Tax Filing for Maryland LLCs

Even though Maryland LLCs are taxed at state and federal levels separately, federal tax filing is always required.

Single-Member LLCs

- Form 1040 + Schedule C

- Due: April 15

Multi-Member LLCs

- Form 1065 (Partnership Returns)

- Due: March 15

- Presumably Receives Schedule K-1

As LLCs Elected S-Corporations

- Form 1120-S

- Due: March 15

As LLCs Elected C-Corporations

- Form 1120

- Due: April 15

For Non-US Owners

If you are a foreign owner of a Maryland LLC:

You may need:

- Form 5472

- Pro-Forma 1120

- Form 1040-NR (If effectively connected U.S. income)

Foreign-owned LLCs also face $25,000 penalties for missing Form 5472 filings, so accuracy is crucial.

7. Maryland Sales & Use Tax (If Applicable)

If your LLC sells tangible goods, digital products, or taxable services in Maryland:

You must register for a (Maryland Sales & Use Tax License)

Filing Frequency:

- Monthly, Quarterly, or Annually (depending on sales volume)

Tax Rate:

- (Statewide) 6%

Businesses with warehouse facilities or inventory stored in Maryland are also responsible for filing.

8. Employer Tax Filing Obligations for LLCs with Employees

Maryland LLCs are required to manage the following with their employees:

Maryland State Requirements:

- Payroll tax registration

- Tax withholdings

- Unemployment insurance

Federal Requirements:

- Form 941: Quarterly Payroll Tax Return

- Form 940: Federal Unemployment

- Filing W-2s

- Filing payroll tax withholding deposits

9. Other County or City Tax Obligations

Certain counties in Maryland impose additional personal property or local business taxes. Examples are as follows:

- Business personal property tax for Baltimore City

- Property Assessments for Montgomery County

Make sure to check your County’s business tax office for any local administrative obligations.

10. Compliance Checklist for Maryland LLC Owners

Maryland State Filings

- Annual report due April 15

- Personal Property Tax Return (if any)

- PTE Tax Election (optional)

Federal Filings

- 1040 + Schedule C for Single Member

- 1065 for Multi-Member

- 1120 or 1120-S if elected

- 5472 if foreign owners

Other Requirements

- Sales tax returns

- Employer tax returns

- Business County Taxes

- Registered Agent Renewal

- Operating Agreement Maintenance

11. What Are the Consequences for Missing Maryland Deadlines?

Your filings missing the stated deadlines may result in the following:

- Late fees, which can accrue via interest penalties

- Loss of good standing status or status in general

- Impeded capabilities, such as

- Bank account openings

- Obtaining Licenses

- LLC Forfeiture, where the Company is shutdown by the State

You may need to pay all your previous fees and missing reports in order to have your business reinstated.

12. Maryland LLC Taxes for Non-U.S. Residents (Important)

International founders often pose the question of how Maryland taxes come into play if they operate the business from outside the United States.

Allow us to oversimplify:

If your LLC has NO United States presence – no employees, no office, no warehouse – then:

- You may not owe Maryland income tax

- File the Annual Report

- File the Federal 5472 and 1120-NR (depending on activities)

If your LLC DOES have presence in the United States or Maryland-sourced income:

- You must file Maryland non-resident returns

- You may owe Maryland state tax

- You must comply with Federal filings

Bizstartz assists Non-U.S. Residents with managing these filings to help avoid penalties from the IRS.

13. How Bizstartz Helps Maryland LLC Owners Stay Compliant

Bizstartz completes the work with:

✅ Annual Report Filing (Maryland SDAT)

✅ Personal Property Tax Return

✅ Obtaining the EIN + ITIN

✅ Preparation and filing of Federal taxes (1065, 1120-S, 1040-NR, 5472)

✅ Sales & Use tax filing

✅ Bookkeeping & payroll

✅ Renewal of Registered Agent

✅ Reminders for IRS & state deadlines

Bizstartz will handle all of your compliance so you can go on and grow your business, whether you are a U.S. entrepreneur or a non-U.S. resident running a Maryland LLC remotely.

Conclusion, This Section, This is how it is concluded

Everybody, also LLC owners in Maryland, need to comply to both state and federal laws to remain in good standing and so, avoid being penalized. The further you stay away from these laws, the more trouble you will be in.

- Filling in the Annual Report every year on April 15

- Finishing the Personal Property Tax Return (if needed)

- Paying state income tax to Maryland (if you need to)

- Filling in all the federal IRS documentation depending on the structure of the LLC

- Satisfying sales tax or employer requirements

Not complying will bring in expensive penalties, administrative shut down, and legal trouble.

Should you want assistance when it comes to annual filings, we at Bizstartz are more than happy to assist you.