If you’re outside the U.S. but making money from American sources or running a business in the U.S., you might have heard the abbreviation ITIN. That means Individual Taxpayer Identification Number, a key element in fulfilling tax obligations in the U.S.

Lots of international business people, especially those who have a U.S. LLC, come across the ITIN when they need to file taxes, open a U.S. bank account, access payments through services like Stripe or PayPal, and follow IRS regulations.

For those applying from outside the country, the ITIN application can certainly feel a bit daunting.

That’s why we’ve created this guide to answer your questions about how to apply for the ITIN number, who needs it, and how Bizstartz can guide you through it seamlessly.

Understanding ITIN

A tax ID and number comes in the form of a series of 9 digits, issued by the IRS to U.S. Tax Payees. The ITIN is issued to those who need to meet tax obligations in the U.S. but do not qualify for a Social Security Number and must comply with U.S. tax regulations.

Format example: 9XX-XX-XXXX

An Individual Taxpayer Identification Number (ITIN) does not provide legal immigration status, authorization to work in the U.S., or Social Security benefits. It literally only assists the U.S. government in tax processing and reporting.

ITIN Important Features:

- Only the IRS issues them.

- They are used for tax filing, reporting, and compliance.

- They are needed for non-U.S. citizens, resident aliens, or foreign nationals with a U.S. tax filing requirement.

- They help ensure that everyone, regardless of immigration status, can pay taxes legally in the country.

For example, foreign business owners with U.S. tax obligations, such as an LLC, must file U.S. tax returns and will need an ITIN to be identified by the IRS for tax purposes.

Who Needs an ITIN?

You will need an ITIN if you are a foreign individual and you need to file or report taxes to the U.S., but you are not eligible for an SSN.

Some common scenarios where an ITIN is needed are:

1. Non-U.S. Residents Owning a U.S. LLC or Corporation

- If you have formed a U.S. LLC through Bizstartz, you need to file annual tax reports with the IRS.

- An ITIN allows you, as a non-resident owner, to file your personal tax return (Form 1040-NR) and account for your income share.

2. Nonresident Aliens Earning U.S. Income

If you are a non-resident alien earning income directly from the U.S. (this includes rent, royalties, dividends, and payments for services), you must obtain ITIN to report that income to the IRS.

3. The dependents and spouses of U.S. citizens or residents.

If a foreign spouse or dependent does not have an SSN and is listed on a U.S. tax return, they must apply for an ITIN.

4. Foreign investors or real estate owners.

Foreigners buying and selling properties in the U.S. must obtain an ITIN to pay and reclaim taxes under the Foreign Investment in Real Property Tax Act (FIRPTA).

5. Internationals students and researchers.

International students or researchers receiving taxable scholarships or grants from U.S. institutions will also need an ITIN.

6. Freelancers and Remote Workers Serving U.S. Clients

If you are a freelance professional based outside the U.S. and providing services to U.S. clients paid via U.S. payment systems, you may also need an ITIN for tax purposes.

In all, If you are a non-U.S. individual involved in income and tax matters here in the U.S., you will need an ITIN.

Why Is An ITIN Important?

An ITIN is more than just a tax number. It opens multiple avenues for non-U.S. residents to handle finances and conduct business. Here is a breakdown on its importance:

1. Assures IRS Tax Compliance

U.S. tax obligations require all income to be reported. You may not be in the U.S., but your business activities might create income tax obligations. An ITIN allows the non-resident to file tax returns and pay taxes to the U.S. government. This helps in avoiding IRS penalties and audits.

2. Assist in Opening A U.S. Bank Account.

Opening a business or personal account in U.S. banks and fintech platforms often requires an ITIN or SSN. Without one, it may be difficult to manage the finances of your LLC.

3. Enables Payment Processor Verification.

Payment processors such as Stripe, PayPal, and Amazon require tax identification numbers to verify your account. An ITIN allows for an unobstructed payment gateway.

4. Enables Claiming Tax Treaty Benefits.

An ITIN lets you claim benefits from tax treaties between the U.S. and your country. Tax treaties often prevent double taxation. Without an ITIN, you cannot avoid double taxation.

5. Refund and Tax Credit Support

You can only get a refund for overpaid taxes through your ITIN, and this also lets you access a few credits, including the Child Tax Credit if you qualify.

6. Compliance Support for LLCs

The ITIN is also a compliance requisite for foreign entrepreneurs starting a U.S. LLC as they will need to file an annual tax return and connect the owner to the company’s EIN.

Documents You Need to Get an ITIN

Prior to getting your ITIN, you should consolidate all the required documentation. Accurate and verifiable documentation will help reduce the chances of delays.

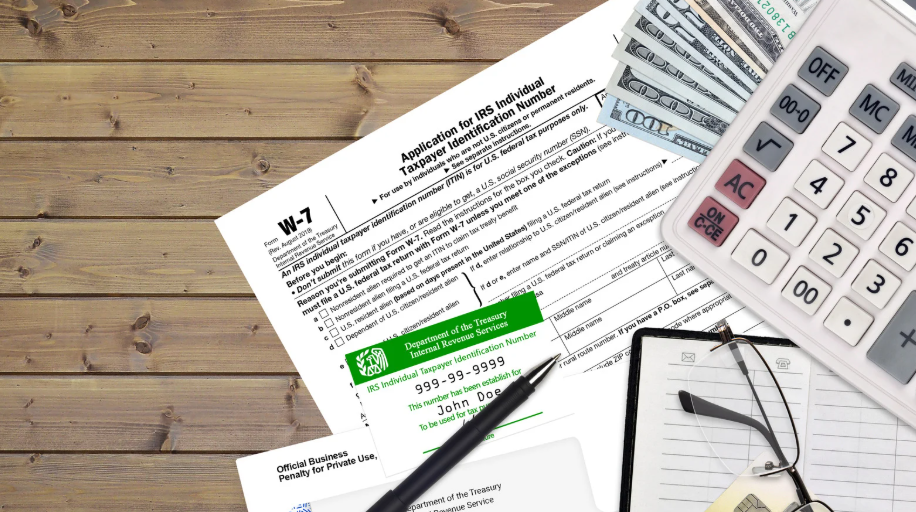

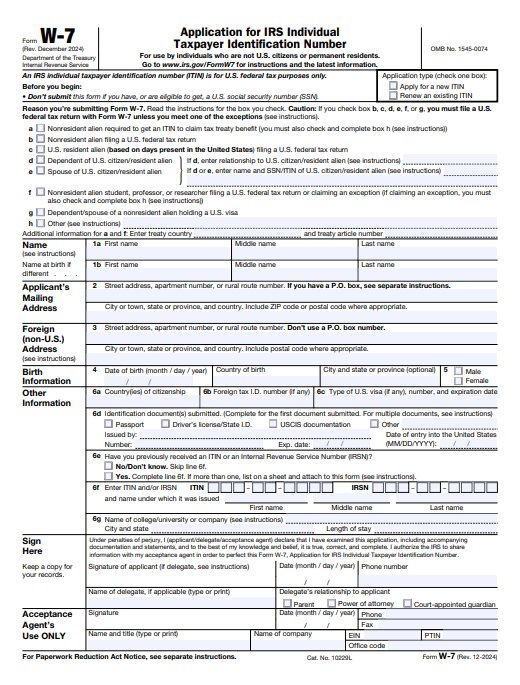

1. Form W-7 (IRS Application for ITIN)

This is the primary form you need to fill out to apply for an ITIN. It asks for:

- Your name, address, and birthdate

- Citizenship

- Type of US visa (if applicable)

- Reason for applying (the form has 9 reason codes)

2. Proof of Identity and Foreign Status

The IRS recognizes 13 different document types, but your passport remains the more trustworthy option as it can serve both identification and foreign status purposes.

If you choose not to provide your passport, you need to provide at least 2 more documents from the IRS-approved list, including:

- National ID card (photo, name, current address, date of birth, expiration date)

- U.S. visa

- Birth certificate

- Foreign driver’s license

- School records (for dependents under 18)

3. U.S. Federal Tax Return

As long as you do not qualify for an exception, the U.S. tax return (Form 1040, 1040-NR, or 1065) must be included with the ITIN application. This lets the IRS confirm that you actually need an ITIN.

4. Supporting Documents (if applicable)

These can be:

- LLC formation certificate or EIN confirmation letter

- U.S. business contracts or invoices

- Letter from a withholding agent

- Scholarship or grant documentation (for students)

How to Apply for an ITIN: Breakdown of the ITIN Application Process

Three different methods can be used to apply for an ITIN. Each has different advantages based on your location.

Option 1: Apply by Mail to the IRS

This is the most traditional method that most people still use.

Step 1. Complete Form W-7.

Make sure that your name, your reason code, your address, and the other fields are completely filled and correct.

Step 2. Attach Supporting Documents.

Send your passport (or certified copy of the passport) and your U.S. tax return.

Step 3. Mail your Application.

Send your complete application to:

U.S. IRS

ITIN Operations,

P.O. Box 149342,

Austin, TX 78714-9342,

USA

Step 4. Wait for Processing.

ITIN processing generally takes 8-12 weeks and can take longer during tax season.

Option 2: Apply Through a Certified Acceptance Agent (CAA)

Certified Acceptance Agents (CAA) are approved by the IRS to verify your documents and apply for the ITIN in your behalf.

Advantages of using a CAA:

- You don’t have to mail your original passport to the IRS.

- The CAA can validate your identity documents.

- The process is more secure and quicker.

- Processing is more efficient.

- Best suited for applicants living outside the U.S.

At Bizstartz, we work with IRS approved CAAs and assist clients apply for ITINs safely, without needing to send original documents overseas.

Option 3: Apply In Person at an IRS Taxpayer Assistance Center (TAC)

If you’re in the U.S., you can also book an appointment at a Taxpayer Assistance Center.

For this, you’ll need to bring:

- Your completed W-7

- Proof of identity and foreign status

- Your U.S. tax return

An IRS officer will inspect your documents and proceed with your ITIN request.

How Long Does It Take to Get an ITIN?

The processing time depends on your method of application:

| Method | Estimated Processing Time |

| By Mail | 8–12 weeks |

| Through CAA | 4–6 weeks |

| In Person at TAC | 3–6 weeks |

Once your application is approved, you’ll get your ITIN letter directly from the IRS.

If something is missing or IRS documents do not match, the IRS will send you a letter for clarification.

Common Mistakes to Avoid When Applying for ITIN

1. Sending Your Original Passport When Certified Copies Are Required

Many applicants send original passports to avoid the delays of a certified CAA, which can result in losing or delaying the application.

2. Incorrect Reason Codes On Form W-7

There are 9 reason codes, and you’ll need to make sure to select the one that correctly applies to your situation (like “nonresident alien filing a U.S. tax return” or “owner of a U.S. LLC”).

3. Not Completing the Application Properly

If you leave any fields blank, don’t sign, or forget to send your tax return, the application is likely to be rejected.

4. Expired Documents

Every passport or ID must be valid and not expired at the time of submission.

5. Incorrect Mailing Address

Please confirm that your mailing address is accurate. The IRS sends your ITIN approval notice in the mail directly, so make sure your address can reliably receive international mail.

How Bizstartz Can Help You Get Your ITIN

Bizstartz simplify the ITIN application process for international entrepreneurs and international business owners.

We offer:

✅ Document preparation (Form W-7 and tax return)

✅ Document certification by our CAA partners

✅ Submission tracking and status updates

✅ Support for LLC owners and foreign individuals applying from overseas

Bizstartz ensures that your ITIN application meets the requirement so you can use it for tax filing, banking, or LLC compliance.

Our clients from over 70+ countries have successfully obtained their ITINs from us. They didn’t have to send us original passports or deal with confusing IRS paperwork.

Frequently Asked Questions (FAQ)

1. Can I request an ITIN if I do not have a U.S. tax return?

Yes, but only if you have an exception, such as being the owner of a U.S. LLC, and you are applying to open a bank account or tax treaty benefits. Bizstartz can help you determine what exception fits your situation.

2. Is my ITIN permanent?

Your ITIN will not expire, but if it is not used for three consecutive years it will go inactive. After this time, you can renew it with a simple application.

3. Can I use my ITIN instead of an SSN?

You can use your ITIN for tax purposes, but not for employment and social benefits.

4. What is the difference between an EIN and an ITIN?

- EIN (Employer Identification Number): Used for businesses (LLCs, corporations).

- ITIN (Individual Taxpayer Identification Number): Used for individuals, such as nonresident owners or partners.

5. Can Bizstartz apply for an ITIN on my behalf?

Yes. Bizstartz partners with IRS-certified acceptance agents to file your ITIN application properly and securely from any part of the world.

Final Thoughts

If you’re not a U.S. citizen and want to do business in the U.S., getting an ITIN is a huge first step. This helps you comply with IRS regulations, gain access to U.S. bank accounts, get paid by customers, and enhances the credibility of your business in the U.S.

If you’re not in the U.S., applying for an ITIN can be a long, complex process if you try to do it on your own. That’s why we offer the service to ensure the process is seamless, accurate, compliant, and gives you the peace of mind you deserve.

🚀 Start Your ITIN Application Today with Bizstartz

We assist non-U.S. residents in obtaining their ITIN and EIN and completing their business registration.

No confusion, no holdup, just expertly crafted service tailored to the needs of international businesspersons.

🌐 Check us out at www.bizstartz.com

📩 Or reach out to us so you can start your ITIN application.