When considering new locations for business formation, Maine probably isn’t top of mind. However, that’s because it’s a best kept secret for those who appreciate simplicity, affordability, and strong legal protections for their business.

Regardless if you are a U.S. resident starting your first business, or a foreign business owner wanting to set up a legal business in the U.S. Maine LLCs are a great option. They provide great LLC formation options that are flexible, and protective and enhance your business’s credibility.

In this guide, we will explain the process of forming an LLC in Maine, and break down the requirements, costs, obligations, and steps that will ensure compliance and keep your business moving.

Why Form an LLC in Maine?

Maine has a great advantage for small and mid-sized businesses and it is their low cost of doing business combined with Maine’s strong liability protections and low friction state filing system.

Maine LLC formation is a great step for businesses looking for:

Affordable Formation Costs

While Maine charges $175 for filing in comparison to California and Massachusetts whose filing fees are $500+, this is very cheap from the perspective of new business owners and start ups.

Limited Liability Protection

With an LLC, your personal assets will not be affected by your Maine LLC. If your business is faced with lawsuits or debt, your possessions will not be targeted.

Simplified Compliance

Maine LLCs have minimal ongoing requirements. Most importantly, an LLC has to file an Annual Report to remain in good standing status.

Flexibility for Non-U.S. Owners

Maine LLCs do not have citizenship requirements. Therefore, foreign business owners can register, as well as manage, a Maine LLC regardless of their residency status in the United States.

Business-Friendly Environment

Maine has modern business laws that are welcoming to remote businesses, eCommerce businesses, and consultants that cater to U.S. consumers, no matter their location.

If you are planning on using eCommerce tools like Amazon, Shopify, Stripe, or Upwork, having a Maine LLC will enhance the business’s professionalism.

Step 1: Select a Name for Your Maine LLC

Picking a name is the first step as it is the first part of the identity of your Maine LLC. All business LLC name in Maine must follow the following standards:

Naming Rules:

- Contains the words “Limited Liability Company,” “LLC,” or “L.L.C.”

- Does not contain the words “bank,” “insurance,” or “corporation” unless licensed.

- Differs from all Maine business name registries.

- Does not describe illegal activity or suggest a government affiliation.

You can find registered business names using the Maine Secretary of State Business Entity Database.

If you will not immediately file your LLC, you can reserve your name for 120 days by filing an Application for Reservation of Name and paying a $20 fee.

💡 Strategy: Use names in line with your business model and brand. For Maine based or remote service businesses LLC names work well are “Pinewave Consulting LLC” or “Atlantic Digital LLC.”

Step 2: Choose a Registered Agent in Maine

A Registered Agent is a person or corporation which receives official correspondence from the government, legal documents, and other compliance papers in the name of your LLC.

To qualify, the Registered Agent must:

- Have a physical street address in Maine (no P.O. boxes).

- Be available to receive legal papers during business hours.

- A Registered Agent can also be a business or member of your LLC, or a Maine friend.

If you own a business in another country and don’t have an address in the U.S., you must have a local Registered Agent. For Maine, you can use Bizstartz. They will help your LLC remain compliant and help you receive legal documents.

💡 Why it matters: If your Registered Agent doesn’t receive important documents (like a lawsuit or government notice), your LLC could lose good standing or face other penalties.

Step 3: File the Maine Certificate of Formation

The Certificate of Formation is the official document which legally creates your LLC with the Maine Secretary of State.

Things You Need To Include:

- LLC Name

- Registered Agent Name and Address

- Principal Business Address

- Type of Management: Member-managed (owners run the company) or manager-managed (you hire a manager)

- Duration of the LLC: Most choose “perpetual,” meaning it doesn’t automatically dissolve.

Filing Options:

- Online filing: Fast and convenient through the Maine Secretary of State portal

By mail:

Department of the Secretary of State

Division of Corporations, UCC, and Commissions

101 State House Station, Augusta, ME 04333-0101

Fee:

- $175 (payable to “Secretary of State”)

Once your filing is approved, you’ll receive a Certificate of Formation confirmation, your LLC is now legally registered in Maine!

Tip: Bizstartz can handle this entire step for you, ensuring your forms are correctly completed and approved faster.

Step 4: Create an Operating Agreement

While Maine does not require an LLC to have an Operating Agreement, it’s one of the most important internal documents for your company.

What Is An Operating Agreement?

This is a formal document which describes how your LLC will function. It will describe:

- The holdings of each owner (who owns what percentage)

- The duties of each member, their rights, and the responsibilities of each member

- The distribution of profits and the responsibility for losses

- The provisions for voting on the allocation of profits, and the responsibility for losses

- The addition and removal of members (and how they can be added)

- The closure of the LLC and the provisions for dissolving the LLC

An Operating Agreement will help avoid conflicts between members, and provide proof that your LLC is legally recognized as a separate entity. This increases your liability protection.

💡 Single-member LLCs: Even when you are the lone owner, an Operating Agreement will be advantageous when establishing a U.S. bank account, or in other dealings with banking institutions.

As part of our LLC packages, Bizstartz provides professionally drafted Operating Agreements tailored to your ownership structure.

Step 5 Obtain An EIN (Employer Identification Number)

An EIN (employer Identification Number) is an identifier that the IRS issues to your business and is also a tax ID. It is used when:

- Filing U.S. taxes

- Opening a U.S. business bank account

- Hiring employees

- Registering for payment processors (ex. Stripe, PayPal, and Shopify Payments)

How to Get an EIN

You can apply for an EIN through the IRS website, if you are a U.S. citizen.

But if you’re a foreign national and you don’t have a Social Security Number (SSN), it’s a different story for you. You’re going to have to manually send Form SS-4 by fax or mail. This could take weeks!

This is where Bizstartz comes in. We take care of the entire EIN process for foreign-owned LLCs to guarantee your EIN is issued properly even if you don’t have an SSN.

Step 6: Submit the Annual Report to the State of Maine.

To keep your LLC in good standing with the state of Maine, you must submit an Annual Report.

Important information to note:

- Due Date: June 1 every year

- Cost: $85

- Method of Submission: Online or by mail

The report includes changes to your company’s information, including your address and information of your Registered Agent.

Failure to submit your report on time can result in a late fee or even have your company dissolved by the state.

Bizstartz has compliance reminders and filing services to keep your Maine LLC in good standing and avoid penalties.

Step 7: Open a U.S. Business Bank Account

After you’ve received your LLC and EIN, your next step is to get a U.S. business bank account. This is necessary to keep your business and personal finances separate.

Required Documents:

- Certificate of Formation

- EIN Confirmation Letter

- Operating Agreement

- LLC Member Passport or ID

- Business address and Registered Agent details

Many U.S. Banks offer remote account opening to non residents through partners like Mercury, Relay, and Wise.

Bizstartz helps you with U.S. Bank account opening, even if you don’t live in the U.S. This includes account, verification and documentation submission.

Step 8: Register for Taxes and Business Licenses

You might also need to register for state and federal taxes or business licenses based on your business activity. LLCs in Maine, for example, need to take these actions:

- Register for federal taxes with the IRS and your EIN.

- Register for Maine income tax and/or sales tax if you need to collect Maine state taxes.

- Get a sales tax permit if you sell goods in Maine or to Maine customers.

- You can register for these on the Maine Revenue Services (MRS) website.

Also, consider local permitting and licensing requirements which may apply to industries like construction, retail, or consulting.

💡 Tip: Before launching any business, it’s wise to identify all state and federal tax obligations and obtain the necessary permits, as Bizstartz does for its clients.

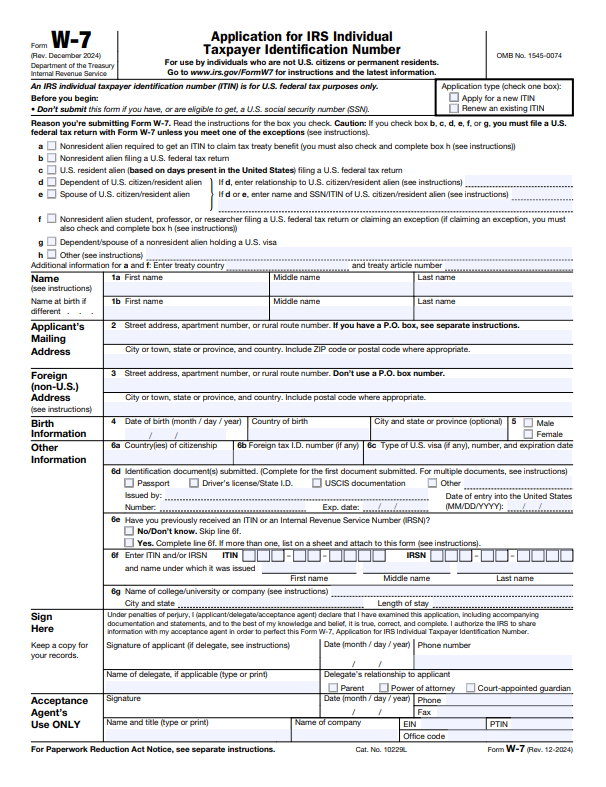

Step 9: Apply for an ITIN (For Non-U.S. Owners)

As a foreign entrepreneur without a Social Security Number, you will most likely need an ITIN (Individual Taxpayer Identification Number).

An ITIN allows you to:

- File federal tax returns

- Report income earned through an LLC in the United States

- Open bank accounts and receive payments from American payment processors

To apply for an ITIN, you need to fill out Form W-7 for the IRS and submit it with documents for identity verification. Even if you are abroad, Bizstartz assists clients internationally with all steps in the ITIN application in a timely and correct manner.

Step 10: Maintain Ongoing LLC Compliance

Developing your LLC in Maine does not exempt you from additional future responsibilities as your business develops. You are still required to fulfill federal and state obligations every year to maintain good standing.

You must do the following:

- File your Annual Report

- Keep your Registered Agent active

- Keep a business bank account separate from your personal account

- File taxes on a federal and state level

- Maintain business records and minutes of meetings

If you do not obey, you will incur penalties, lose liability protection, or face administrative dissolution.

Bizstartz provides ongoing compliance management, so you can grow your business while we handle the paperwork.

Cost Summary: Maine LLC Formation Overview

| Step | Description | Cost |

| Name Reservation (optional) | 120-day reservation | $20 |

| Certificate of Formation | State filing fee | $175 |

| Registered Agent Service | Annual | $50–$150 |

| Annual Report | Yearly filing | $85 |

| EIN Application (via Bizstartz) | For non-U.S. founders | Included in package |

| ITIN Application (if needed) | Optional | Additional service |

Why Choose Bizstartz to Form Your Maine LLC?

Unlike most LLC management companies, Bizstartz does not limit its clientele to U.S. residents. We help global entrepreneurs to set up and manage LLCs anywhere in the U.S., including Maine.

We offer,

- LLC Formation and State Filing

- Registered Agent Service

- EIN Application (without SSN)

- Operating Agreement Preparation

- Beneficial Ownership Information (BOI) Filing

- Individual Taxpayer Identification Number (ITIN)

- U.S. Bank Account Setup

- Bookkeeping and Tax Filing Support

We offer 100% remote, transparent, and stress-free service, so you can focus on growing your business.

Final Thoughts

Establishing an LLC in Maine is one of the most efficient and effective ways to create a legitimate business presence in the U.S. Maine is incredibly business-friendly. Entrepreneurs can benefit from low compliance requirements, strong asset protection, and low fees.

If you are starting a consulting business, SaaS, or e-commerce, you can enjoy the structural advantages a Maine LLC provides.

Ready to get started?

👉 We Got You Covered with LLC Setup. Bizstartz will handle everything from state filing to EIN and bank account setup. Everything you need is in one place!