Hippie Clothes Wholesale is a rising star in the fashion industry focusing in bohemian, hippie and festival styled clothing. They sell to all types of customers, from retailers and boutiques to direct individual customers, in a wide variety of different countries.

The company is well known for the multitude of distinctive designs, vibrant colors, and hand crafted additions they offer to their customers. They sell their designs all over the world due to their easy affordability, originality, and a sprinkle of cultural references in their designs.

While the company is experiencing great success internationally, their founder was able to discover a gap in the U.S. fashion and e-commerce market. There is a wide variety of unique alternative styled clothing and many unique boutiques in the United States which happens to house millions of online shoppers. This is extremely important to companies like Hippie Clothes Wholesale because they sell their clothes on Amazon, a selling platform with a wide consumer base.

But, there are major challenges when trying to enter the US market for the first time. The hoops you have to jump through to form a legal entity, pay the taxes required, and complete Amazon’s document verification are rather confusing. This is why the company reached out to Bizstartz.

The Challenge

- When we were approached by Hippie Clothes Wholesale they already had an idea in mind:

- Create a legal business entity in the US for better operational credibility.

- Acquire the required compliance documentation to obtain and pay taxes lawful in the U.S.Create a bank account to receive payments from Amazon for business operational managers.

- Acquire Amazon Seller Central to unlock direct selling capabilities for the United States business market.

However, the founder had legitimate issues, too:

U.S. Business Formation Complexity

For non US residents, forming a company in the U.S. is a puzzle. Every state has its unique set of rules, documents, and costs. Added to these, unlayering the legal intricacies of remote jurisdiction still felt overwhelming.

IRS Compliance & EIN (Tax ID)

Legally working in the United States is a complicated process for non-citizens, and is near impossible without having an EIN (Employer Identification Number). It’s a foundation for opening a bank account, filing taxes, and even more registering on selling platforms like Amazon. Perhaps the most tough challenge from outside the United States is having to deal with the IRS.

Difficulty in Opening a U.S. Business Bank Account

Many U.S. banks require physically visiting a branch to open an account, and to also complete a number of compliance checks and excessive reports. For non-resident business owners, this seems to be the most difficult process, and is often considered the most complicated part of the entire process of acquiring a U.S. business bank account.

Amazon Seller Account Approval

Amazon has very lengthy procedures to verify sellers from different countries, and many get rejections due to incomplete or incorrect information. Our client was struggling to understand how to prepare documents that articulate the true nature of the client’s business.

Each of these issues could impact business entry in the U.S. market, if not completely stop it. They came to us at Bizstartz to set up the business and all the related processes.

Our Strategy

At Bizstartz, we helped Hippie Clothes Wholesale smoothen their business entry into the U.S. market and ensured all necessary compliances were verified.

1. US LLC Formation

We started with the formation of a Limited Liability Company (LLC) in the United States, as an LLC comes with the following advantages:

- Protection of personal and business liabilities.

- Non-residents friendly tax system.

- Recognition and trust with the Amazon seller, U.S. client, and banks.

We helped the client decide which was the most advantageous state for them to set up their LLC.

2. Applying for an EIN (Tax ID)

After registering the LLC, the other business contour which we define, is applying for an EIN with the IRS. Like for individuals, the business also has to obtain a ” Social Security Number ” which is an Employer Identification Number (EIN) for the purposes of:

- Opening a U.S. business bank account.

- Registering on Amazon and with other payment processors.

- Correct filing and tax reporting.

Bizstartz took complete responsibility of the application process and obtained the EIN which confirmed that Hippie Clothes Wholesale was a legitimate business operating in the US.

3. Opening a U.S. Business Bank Account

Having a bank account in the US is a great challenge for international business owners. During the process, we help the client complete everything to the last detail with maximum convenience.

All the required documents were assembled and we took the client through the process account to make the account seamlessly, fully.

4. Setting Up an Amazon Seller Account

The last step we guided Hippie Clothes Wholesale through was the setting up of an Amazon Seller Central account. Amazon needed legal documents, a proof of the existence of the business, authentic bank documents, and all the business details for account verification. Missing a step in this phase can cause Amazon to suspend the account or deny it altogether.

Bizstartz applied due diligence in preparing the application and advising the client through the steps of account verification, ensuring that all documents were in order. This resulted in instant approval of the account, giving them the ability to immediately start selling and listing products on Amazon U.S.

The Results

Thanks to our assistance, Hippie Clothes Wholesale was able to achieve their goal of establishing a legal entity in the U.S.

Some of the desired outcomes included the following:

✅ A U.S. LLC was fully registered, giving them an added layer of credibility as well as legal protection under U.S. business laws.

✅ A valid EIN able to assist the client in complying with the requisite taxes as well as helping with Amazon account verification.

✅ A functional business bank account in the U.S. that allows seamless transfers and payments from Amazon.

✅ Instant approval of an Amazon Seller Central Account which offers them countless customers in the U.S.

Hippie Clothes Wholesale can now utilize their growth opportunities to scale their operations as well as brand awareness in the U.S, which is one of the most profitable markets for e-commerce.

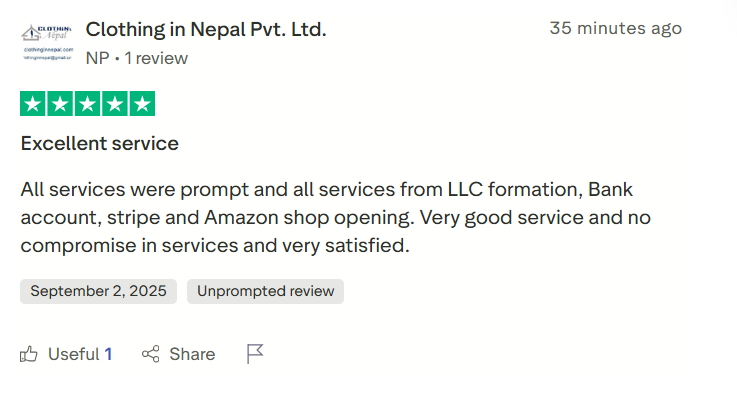

Client Testimonials

Conclusion

To most non-US entrepreneurs, venturing the United States seems to be more like a fairy tale than reality due to the perceived legal and monetary obstacles. However, with appropriate information, even the most overwhelming tasks can be simplified and organized to an attainable goal.

Hippie Clothes Wholesale is a testament to how Bizstartz enables global entities overcome the hurdles and thrive in the US market. It does not matter how complex the task is, from establishing an LLC to getting an Amazon account approved, our team does everything to the highest degree of quality.

If you are a global entrepreneur who is planning to enter the United States market, Bizstartz is here to assist you with the LLC formation, EIN application, US bank account set up, Amazon account registration, and compliance help in an organized and low tension manner.

Build your US business with us today – we are more than willing to help you.