To comply with U.S. tax regulations, you may need an ITIN, or Individual Taxpayer Identification Number, if you are earning money in the United States but not eligible for a Social Security Number (SSN).

Complying legally and financially with United States laws starts with understanding the ITIN, regardless of whether you are a foreign entrepreneur, an investor, a student, or a dependent.

This comprehensive guide explains everything from what an ITIN Number is and who needs one to how to apply and avoid common pitfalls, as well as how Bizstartz can assist you with reputable professional guidance throughout the process.

What is an ITIN?

An Individual Taxpayer Identification Number, or ITIN, is a distinct nine-digit tax processing number allocated by the IRS (Internal Revenue Service).

It caters to individuals who lack a Social Security Number from the Social Security Administration, yet need to fulfill U.S. tax requirements.

The format of the number is like that of an SSN:

🔢 9XX-XX-XXXX

To provide unattached foreigners and individuals,who do not qualify under a certain criteria, to meet US tax filing requirements, the ITIN has been designated. Aside from the important role that it plays in the federal tax system, the ITIN is bound within these limits:

- It cannot function as a work permit.

- It does not guarantee immigration status.

- Civil rights as citizens of the government are not available to holders.

🔎 The IRS has clearly stated that the only function of the ITIN is as a federal form of tax reporting. Allowing income to be reported, taxes to be paid, and certain tax rebates to be claimed no matter what one’s condition is, is the work of ITIN.

👤 Who Needs an ITIN?

United States citizens, foreign nationals, or individuals conducting business outside the US are eligible for an ITIN if they have relations, legal or financial with the US. The following explanation may help you assess whether you need an ITIN.

📌 Common Scenarios Requiring an ITIN:

- Non-resident aliens who are obligated to pay taxes in the US as mandated within the tax-eligible boundaries of the IRS.

- US resident aliens (determined by physically present in USA for certain number of days) who are also tax filers.

- Spouses or dependents of U.S. citizens or resident aliens who are not eligible for SSNs.

- Spouses or dependents of non-resident visa holders (H-1B, F-1, L-1).

- Foreign investors, partners, or LLC members who derive income from the U.S or have a business entity like an LLC or LLP.

- Non-resident individuals deriving rental income, dividends, royalties, or interest from U.S. assets.

- Foreign students, scholars, or faculty members undertaking tax returns or tax treaty claims.

- Claiming tax treaty benefits for reducing tax liability resulting from simultaneous taxation.

🧾 Note: Without requiring physically visiting or living in the US, having certain connections such as an income classified under the US system may activate certain obligations including filing for taxes, which require an ITIN number.

What’s an ITIN and Why is it Important?

For non-residents, ITIN provides access to the United States taxation territory and enables compliance with legal obligations. This is the reason issuance of ITIN is vital:

💼 Primary Advantages of ITIN

Facilitates US Income Tax Return Filling

Having income from the US, foreign nationals signifies a legal obligation of reporting income from within the border and taxation on it. Form 1040, 1040NR and several other forms requires ITIN for submission.

Claim Tax Treaty Benefits

The U.S. has treaties with over sixty different countries. These treaties can diminish or withdraw taxes on dividends, interest, royalties, and other income. To claim tax treaty benefits, an ITIN is necessary.

Receive Tax Refunds

You may receive a refund if excess income tax was withheld. However, you must submit a tax return with an ITIN to get the refund.

Claim Tax Credits

Certain non-citizens are eligible to receive refundable tax credits such as:

- Child Tax Credit (CTC)

- American Opportunity Tax Credit (AOTC) for students

- Other education or dependent credits

Open U.S. Bank or Brokerage Accounts

Numerous financial institutions request an ITIN to permit foreign nationals to open checking, saving, or investment accounts, especially if personal identification numbers like SSN are absent.

Comply with Foreign-Owned LLC Tax Requirements

If you are a foreign owner of a U.S. LLC, you may be subject to Form 5472 and Form 1120 filing obligations. These filings are bound by the tax identification number mandate.

🚀 If you are starting a U.S. business, increasing your presence globally or investing in real estate or stocks in the US, acquiring an ITIN should be an essential part of your strategy.

🚫 Restrictions on the ITIN

While the ITIN is beneficial when paying taxes, it has strict limitations which delimit its usefulness. It is not an SSN, and does not offer any legal protections aside from tax eligibility.

⚠️ Key Limitations:

| Limitation | Explanation |

| ❌ Not valid for work | You cannot use an ITIN to work legally in the U.S. Employers may not accept it for employment purposes. |

| ❌ No eligibility for benefits | ITIN holders cannot receive Social Security, Medicare, unemployment, or retirement benefits. |

| ❌ No immigration status | Possessing an ITIN does not make you eligible for a visa, green card, or U.S. citizenship. |

| ❌ Limited identification use | It’s not considered an official ID by most federal and state agencies. |

| ⏳ Subject to expiration | ITINs must be used at least once every three years or they will expire. Older ITINs issued prior to 2013 are subject to automatic renewal cycles. |

🛑 Many people incorrectly assume that the ITIN allows people to legally reside or work in the United states, but this is not true. The ITIN was created only for the purpose of identifying taxpayers.

🪪 Is the ITIN a Valid Form of Identification?

The ITIN is not accepted as a form of identification everywhere. It does serve some purpose in banking or other financial operations, but does not count as a form of government identification.

🔍 What the ITIN Cannot Be Used For:

- Gaining access to an airplane for international travel

- Acquiring a state issued driver’s license (from most states)

- Legally verifying age or identity

- Claiming public subsidized housing or healthcare services

ITINs may be accepted by some US banks for identity verification purposes. However, a passport, national ID, or visa is typically required in addition to the ITIN.

📝 How to Apply for an ITIN

This process requires precise preparation and proper documentation. Here are the steps in detail:

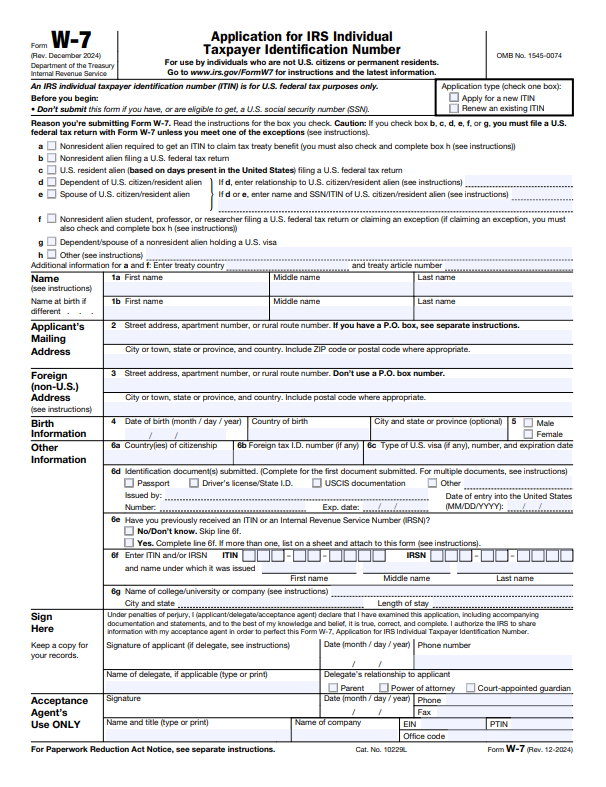

Step 1: Fill Out IRS Form W-7

To apply for an ITIN, you need form W-7. You will be required to:

- Choose the reason for applying

- Provide full name, date, place of birth, and country of citizenship

- Affix signature as the applicant (or parent/guardian, if child)

📌 Your information must match identically with your passport and any other documents submitted.

Step 2: Attach a U.S. Federal Tax Return.

An ITIN application must be accompanied by a tax return unless you are exempt. This may include:

- Form 1040 or 1040-NR

- Form 1120 with 5472 (for foreign-owned LLCs)

- Form 8233 (students/professors claiming tax treaty benefits)

Step 3: Submit Valid Identification Documents

You are required to submit original or certified copies of documents that confirm both:

- Your identity

- Your foreign status

| Document | Proves Identity | Proves Foreign Status |

| Valid Passport (Standalone) | ✅ | ✅ |

| National ID Card (with photo) | ✅ | ✅ |

| Foreign Birth Certificate (for dependents) | ✅ | ✅ |

| Foreign Driver’s License | ✅ | ❌ |

| Civil Registry or Military ID | ✅ | ✅ |

📢 Most common rejections happen due to expired documents, blurred scans, or copies that cannot be verified. Bizstartz reviews your application to make sure it is correct and complete before submission.

📮 Alternative Ways to Apply for an ITIN

Your original passport does not need to be mailed to the IRS. Multiple secure methods exist:

1. ✅ Engage a Certifying Acceptance Agent (CAA)

A CAA is an individual or business permitted by the IRS to:

- Review your original documents

- Confirm your identity

- File your ITIN application instead of you.

💡 Bizstartz collaborates with trusted CAAs, thus relieving you from the need to mail documents or visit the U.S.

2. 🏢 Go to an IRS Taxpayer Assistance Center (TAC)

If you are already located within the United States, you can apply by:

- Making an appointment at an IRS office

- Arriving with all completed documents and necessary forms.

This does not apply to the majority of non-residents residing abroad.

3. 🏛️ Go to a U.S. Embassy or Consulate

Some Embassies and Consulates provide ITIN related services, which include:

- Confirmation of documents

- Submission of your application to IRS.

Service and document availability differs by country.

🤝 How Bizstartz Helps with Your ITIN Application

We specialize in helping clients globally, especially entrepreneurs, investors applying for Bizstartz ITIN ITINs, and withdrawing it for their dependents.

⚙️ What We Provide:

✅ A tailored step-by-step form guideline for each user

✅ W-7 preparation to avert costly mistakes or rejection

✅ Secure communication with CAAs authorized by the IRS

✅ Submission not requiring physical attendance in the U.S.

✅ Comprehensive reporting and correspondence with the IRS on your behalf

We assist foreigners meet their tax obligations in the U.S. without complications, saving you time, stress, and unwanted hassle with the IRS.

🔍 Most Asked Questions (FAQs)

How long does it take to get an ITIN from you?

Standard IRS processing time ranges from six to twelve weeks based on their workload and accuracy of documents submitted. With Bizstartz, most clients see faster outcomes.

Can I legally work in the U.S ITIN?

No, this is a Tax Identification Number ITIN does not permit you to work or be employed in the United States.

Can a bank account be opened with an ITIN?

Some U.S. banks will accept ITINs as long as you provide further verification documents such as a passport. You will be guided to these institutions by Bizstartz.

Do ITINs expire?

Yes, if not used on a tax return for 3 years consecutively, it expires. ITINs issued before 2013 may need to renew even sooner.

Can I get an ITIN if I live outside the U.S.?

Absolutely! Bizstartz offers remote ITIN services worldwide, including form preparation, document verification, and direct IRS submission.

📢 Final Thoughts: Start Your ITIN Journey with Bizstartz

Obtaining an ITIN is a crucial part of navigating the U.S. tax system as a non-resident or foreign national. Whether you’re forming an LLC, investing in real estate, or simply earning U.S.-sourced income, the ITIN is the gateway to legal compliance and financial access.

✅ Why Choose Bizstartz?

Experienced in handling thousands of ITIN cases

Fully remote, fast, and secure processing

Transparent pricing and personalized guidance

No need to mail your passport or travel to the U.S.

👉 Ready to apply for your ITIN with expert help?

Contact Bizstartz today and let us take care of the entire process for you, accurately, securely, and globally.