If you are a business owner or wish to establish a business entity in the USA, one of the critical compliance requirements introduced by the US of A Treasury Department in 2024 is BOI filing, short for Beneficial Ownership Information filing.

According to the Corporate Transparency Act (CTA), nearly all private companies must now disclose identifying information regarding their beneficial owners to the Financial Crimes Enforcement Network (FinCEN).

This is part of the initiative by the US government aimed at preventing financial malpractices and increasing transparency within corporations.

In this guide, we will dive deep into BOI filing in detail, including who is required to file, how to file, the penalties for non-filing, and how Bizstartz can help in filing your BOI reports.

What is BOI Filing?

BOI filing is the process of providing comprehensive information about a business’s beneficial owners to FinCEN, a branch of the United States Department of Treasury. A beneficial owner is an individual who either directly or indirectly:

- Holds over 25% of the ownership interest in a company, or

- Possesses significant control over the company irrespective of ownership percentage.

The Corporate Transparency Act (CTA) has set the reporting obligation in a manner that enables the nation to create a registry for a company’s beneficial owners while effectively plugging gaps that made it possible for anonymous shell companies to aid in illicit operations such as, money laundering, tax evasion, and terrorism financing.

The aim of acquiring BOI filings is to eradicate the opacity surrounding business ownerships in America, and improve the regulatory supervision of both local and international companies operating within the country.

Who Must File BOI Reports?

Businesses and entities based at home and abroad having operations or registered within the U.S. are subject to BOI reporting quotas. Along with the reporting requirements, your organization is likely liable for BOI reporting obligations if it was formed through a document submission to the Secretary of State or its branch office.

These include:

- Limited Liability Companies (LLCs)

- Corporations (both C-Corps and S-Corps)

- Limited Partnerships (LPs)

- Statutory Trusts

- Foreign Companies Registered to Operate in the U.S.

Exempt Entities

There are 23 specific exemptions under the CTA, including:

- Large operating companies with:

- More than 20 full-time employees based in the U.S.

- More than $5 million in gross receipts or sales originating from the U.S.

- A physical office within the borders of the U.S.

- Publicly Listed Businesses

- Credit Unions and Banks

- Insurance Providers

- Finance and Accounting Firms

- Registered Investment Firms

- A select number of non-profit organizations

In case your business is eligible for an exemption, you do not have to file a BOI report. The exemption must be justified and documented and compliance with other applicable laws is necessary.

What Information is Required for BOI Filing?

Every company seeking to file must furnish three sets of information to FinCEN:

1. Reporting Company Information

The following information has to be reported regarding to your entity:

- Full legal name

- Any trade names or “Doing Business As” (DBA) names

- Current business street address

- Jurisdiction of formation (e.g., Delaware, Florida)

- Employer Identification Number (EIN) or Taxpayer Identification Number (TIN)

2. Beneficial Owners Information

Applicable to all beneficial owner individuals:

- Full legal name

- Date of Birth

- Address of residence and optional secondary (not business address or P.O. Box)

- Document number issued by government ID such as passport or driver’s license

- A scan of the ID used

To fulfill the beneficial criteria ownership is defined at 25%, a controlling, proactive position (CEO, Chancellor, CFO, general counsel, etc.) or significant influence on routine decision making).

3. Company Applicant Information

For these companies registered on or after January 1, 2024, the company applicant must also be included. This person is the one who:

- Filed the formation documents, or

- Instructed someone else to do so

Only two applicants can be reported at maximum, and their identifying details as well as ID documents are required.

BOI Filing Process

Filing a BOI report involves several critical steps to ensure compliance and accuracy. Here is a detailed look at the process:

Step 1: Identify Beneficial Owners

Decide who counts as beneficial owner under the CTA. This includes direct owners, indirect owners via trusts or other entities, as well as individuals in control.

Step 2: Collect Information

Provide personal details along ID documents to every beneficial owner and (where applicable) every company applicant. In addition to having the correct information, the details provided must be complete, otherwise, there will regulatory fines to pay.

Step 3: Prepare the Report

Gather the company data, reconcile the company records, and verify if all the information aligns. It is crucial that the information contained in the report is true, up-to-date, and able to be validated.

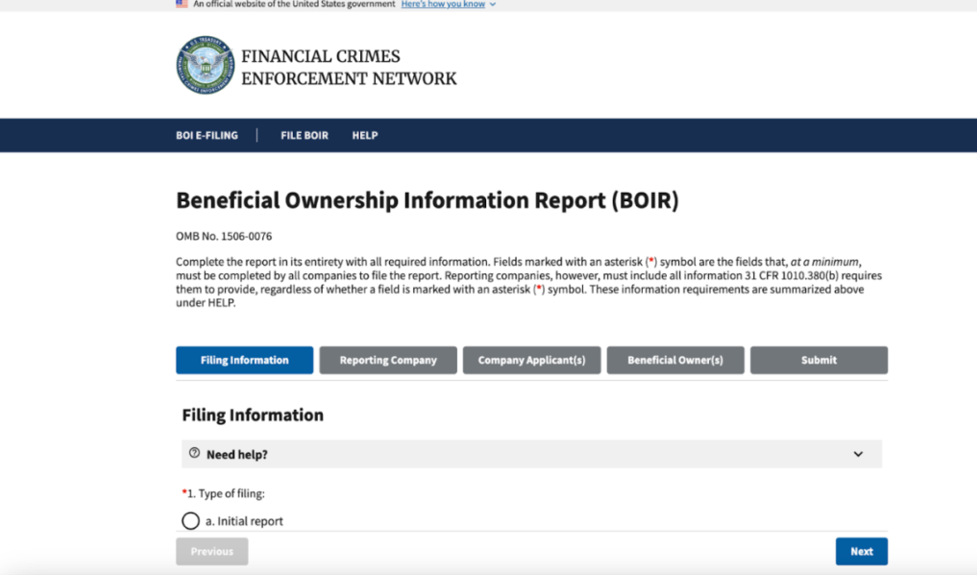

Step 4: File the Report via FinCEN

Reports of the BOI will now be done through the FinCEN BOI E-Filing System which will enable the submission of all required documents/photos through a secure online portal. Submissions via post will no longer be accepted.

Step 5: Track for Changes

After submission, businesses active must monitor for any pertinent changes and report modifications within 30 calendar days of any change in beneficial ownership, company information, or company applicant (if applicable).

BOI Filing Deadlines for 2025

Your submission deadlines timelines are determined based on when the entity is formed or registered:

- Incorporated prior to January 1, 2024

- → Deadline is no later than January 1, 2025

- If incorporated in 2024

- → Submission must be within 90 calendar days from date of incorporation or registration.

- Incorporated on or after January 1, 2025

- → Submission must be within 30 calendar days from date of incorporation or registration.

These timelines are highly sensitive and require close attention, especially for those businesses that have recently been incorporated or bound to incorporate in 2025.

Penalties for Not Filing BOI Report

Failing to comply with the BOI filing requirements is not a minor issue. The CTA establishes both civil and criminal penalties for non-compliance:

- Civil Offenses: Set at $500 for every day the offense is not remedied.

- Criminal Offenses: $10,000 fine plus up to two years in prison.

These penalties can be enforced from:

- The willful misconduct of not submitting a BOI report.

- Submitting fraudulent BOI reports.

- Inaccurate BOI reports where the individual has failed to update or correct.

The legal trouble that can arise if accurate filings are not made is severe, hence care should be taken to fill out these details correctly and promptly.

How to File a BOI Report for a Limited Liability Company (LLC)

This is a step-by-step guidance for filing BOI report for Delphi Associates, LLC BOI report step by step for LLC owners.

1. Identify Your Beneficial Owners

Examine your ownership hierarchy and management-level personnel to identify potential beneficial owners.

2. Gather Required Information

For each beneficial owner, obtain identification documents and personal details including full name, date of birth, residential address, and a government-issued identification document.

3. Log in to the FinCEN Portal

Create a secure account on FinCEN’s BOI E-Filing System or select anonymous one-time filing option to access the system.

4. Input Company and Owner Details

Ensure that all information and scanned identification documents are uploaded and inputted accurately.

5. Review and Submit

Review report for any errors before submission through FinCEN’s BOI E-filing System. Confirmation receipt must be printed and saved.

6. Stay Compliant

File for any case rulings where updates are necessary, including but not limited to identification of ownership changes within thirty days, monitoring, and surveillance timelines.

If an agent or attorney organized your LLC, they might have to be included as the company applicant, especially for formations post-2023.

How Bizstartz Can Help File Your BOI Reports

At Bizstartz, filing with the Board of Investments (BOI) is made simple, seamless, and efficient, especially for international entrepreneurs and small business owners who may not be used to U.S. systems of compliance.

This is how we help.

Consultation and Assessment

We assist you in establishing who your beneficial owners are and if your firm qualifies for an exemption.

Document Preparation

We make certain that all necessary documents for BOI filing are obtained, verified, and securely managed in order to make the filing accurate.

Submission to FinCEN

For now, we will assume responsibility for the entire submission process through the e-filing system of FinCEN.

Ongoing Compliance Support

If you need to amend the report later, we can send you ongoing monitoring and update services.

All this, while partnering with us, ensures that you avoid expensive fines and achieve absolute compliance, giving you the freedom to concentrate more on growing your company.

Need assistance with BOI filing? Contact us or check our BOI Filing Services.

Frequently Asked Questions (FAQs)

Do I have to submit a BOI report every year?

The BOI report is a one-off filing unless there is a change within the ownership structure, change in company or company information, or change in beneficial owners.

Is there a government fee to file the BOI report?

No. FinCEN does not charge any fee for submitting the BOI report.

What counts as substantial control?

Substantial control includes anyone with decision-making authority or influence over key aspects of the company’s operations, finances, or governance, even if they do not own shares.

Can a foreign individual be a beneficial owner?

Yes. Foreign individuals who own or control U.S. entities are required to be reported, regardless of their nationality or residence.

What if I forget to file my BOI report?

If you miss your deadline, you risk civil and criminal penalties. We recommend acting immediately and working with a professional to file as soon as possible.

Final Thoughts

BOI filing represents a major shift in how U.S. companies report ownership information to the federal government. As of 2025, millions of businesses will be required to comply with these new transparency laws, or face steep penalties.

If you don’t know your specific needs or how to undertake filing, working with a reputable provider like Bizstartz can simplify the process for you. Our professionals assist you in achieving the BOI filing requirements accurately and in a timely manner.